[ad_1]

If you want to know who actually controls VERBIO Vereinigte BioEnergie AG (ETR: VBK), then you will have to look at the composition of its share register. Generally speaking, as a business grows, institutions increase their participation. Conversely, insiders often decrease their ownership over time. Warren Buffett said he enjoys “a business with sustainable competitive advantages, led by skilled people and owner-centered.” So it’s nice to see some insider ownership as it may suggest that the management is owner-driven.

With a market capitalization of 3.6 billion euros, VERBIO Vereinigte BioEnergie is rather large. We would expect to see institutional investors on the register. Companies of this size are also generally well known to retail investors. Looking at our data on ownership groups (below), it appears that institutions own shares in the company. We can zoom in on the different property groups, to find out more about VERBIO Vereinigte BioEnergie.

See our latest review for VERBIO Vereinigte BioEnergie

What does institutional ownership tell us about VERBIO Vereinigte BioEnergie?

Many institutions measure their performance against an index that approximates the local market. Thus, they generally pay more attention to companies that are included in the major indices.

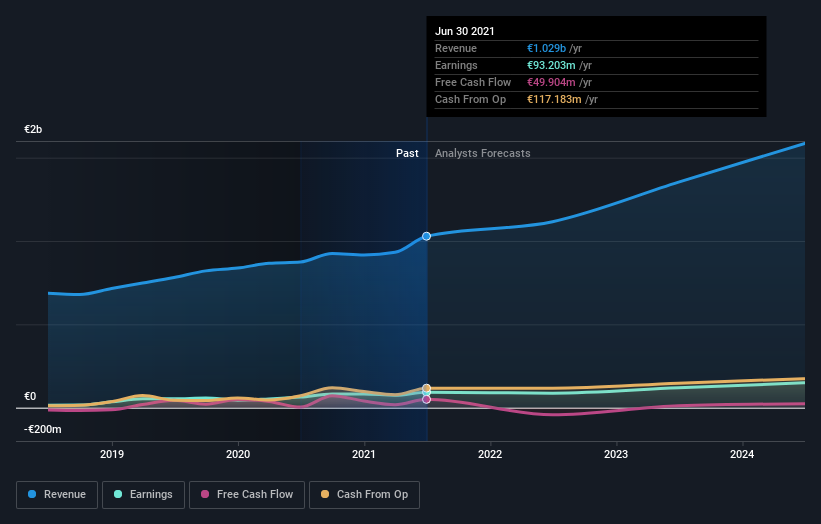

As you can see, institutional investors hold a significant share of VERBIO Vereinigte BioEnergie. This may indicate that the company has a certain degree of credibility in the investment community. However, it’s best to beware of relying on the so-called validation that comes with institutional investors. They too are sometimes wrong. It is not uncommon to see a sharp drop in the stock price if two large institutional investors attempt to sell a stock at the same time. It is therefore worth checking the trajectory of past revenues of VERBIO Vereinigte BioEnergie, (below). Of course, keep in mind that there are other factors to consider as well.

Hedge funds don’t have a lot of shares in VERBIO Vereinigte BioEnergie. The company’s CEO, Claus Sauter, is the largest shareholder with 21% of the shares outstanding. Meanwhile, the second and third shareholders hold 15% and 10% of the outstanding shares respectively. Interestingly, the second shareholder, Bernd Sauter, is also a member of the board of directors, again indicating strong insider ownership among the major shareholders of the company.

Looking further, we found that 54% of the shares are owned by the top 4 shareholders. In other words, these shareholders have a say in the decisions of the company.

Institutional ownership research is a good way to assess and filter the expected performance of a stock. The same can be achieved by studying the feelings of analysts. There are a lot of analysts covering the stock, so you can look at expected growth quite easily.

Insider property of VERBIO Vereinigte BioEnergie

The definition of company insiders can be subjective and vary from jurisdiction to jurisdiction. Our data reflects individual insiders, capturing at least board members. The management of the company manages the company, but the CEO will report to the board of directors, even if he is a member of the board.

Insider ownership is positive when it indicates that executives think like the real owners of the company. However, strong insider ownership can also give immense power to a small group within the company. This can be negative in certain circumstances.

It seems that insiders own more than half of the shares of VERBIO Vereinigte BioEnergie AG. It gives them a lot of power. Insiders hold € 2.1 billion in company shares worth € 3.6 billion. It’s extraordinary ! Most would say this is a positive, showing strong alignment with shareholders. You can click here to see if they have sold their stake.

General public property

The general public has a 16% stake in VERBIO Vereinigte BioEnergie. While this property size may not be enough to influence a policy decision in their favor, they can still have a collective impact on company policies.

Owned by a private company

Our data indicates that private companies own 10% of the company’s shares. It may be worth pursuing the question further. If related parties, such as insiders, have an interest in any of these private companies, this should be disclosed in the annual report. Private companies may also have a strategic interest in the business.

Next steps:

While it is worth considering the different groups that own a business, there are other factors that are even more important. Concrete example: we have spotted 1 warning sign for VERBIO Vereinigte BioEnergie you must be aware.

If you are like me, you might want to ask yourself if this business will grow or shrink. Fortunately, you can check out this free report showing analysts’ forecasts for its future.

NB: The figures in this article are calculated from data for the last twelve months, which refer to the 12-month period ending on the last date of the month of date of the financial statement. This may not be consistent with the figures in the annual report for the entire year.

This Simply Wall St article is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell shares and does not take into account your goals or your financial situation. Our aim is to bring you long-term, targeted analysis based on fundamental data. Note that our analysis may not take into account the latest announcements from price sensitive companies or qualitative documents. Simply Wall St has no position in the mentioned stocks.

Do you have any feedback on this item? Are you worried about the content? Get in touch with us directly. You can also send an email to the editorial team (at) simplywallst.com.

If you decide to trade VERBIO Vereinigte BioEnergie, use the cheapest platform * which is ranked # 1 overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, currencies, bonds and funds in 135 markets, all from one integrated account.Promoted

[ad_2]