[ad_1]

A look at the shareholders of Medtronic plc (NYSE: MDT) can tell us which group is more powerful. Institutions often own shares in larger companies, and we would expect insiders to own a noticeable percentage of smaller ones. Companies that have been privatized tend to have low insider ownership.

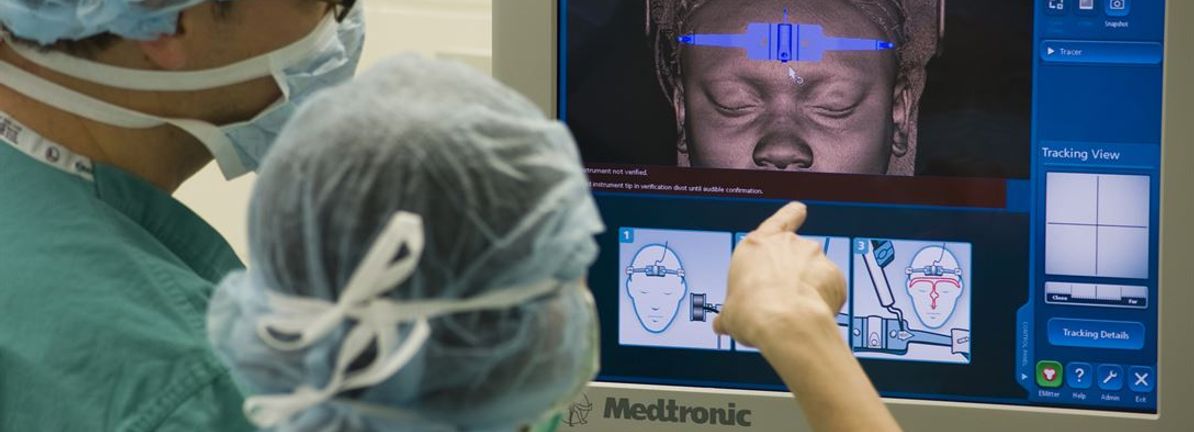

Medtronic has a market cap of US $ 170 billion, so it’s too big to go unnoticed. We expect institutions and retail investors to own a portion of the company. In the graph below, we can see that the institutions hold shares in the company. Let’s dig deeper into each type of owner to learn more about Medtronic.

See our latest review for Medtronic

What does institutional ownership tell us about Medtronic?

Institutional investors generally compare their own returns to the returns of a commonly tracked index. They therefore generally consider buying larger companies that are included in the relevant benchmark.

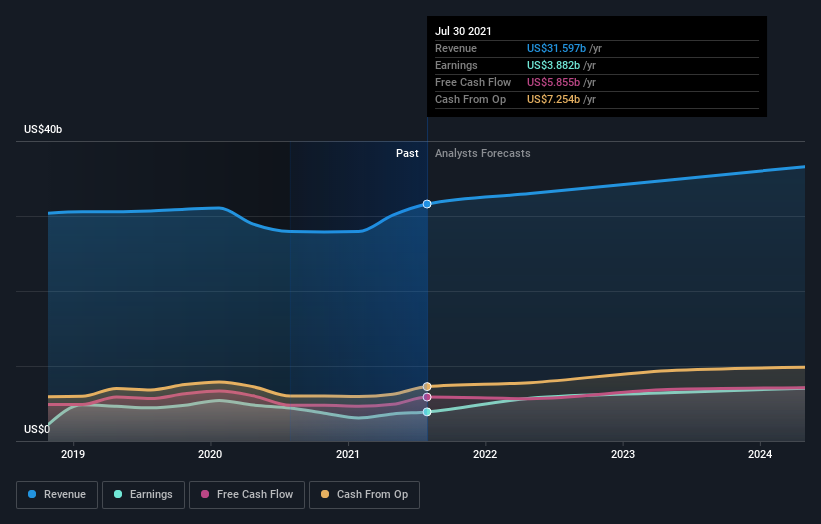

As you can see, institutional investors have a significant stake in Medtronic. This implies that analysts working for these institutions have reviewed the action and appreciate it. But like everyone else, they could be wrong. When several institutions hold a stock, there is always a risk that they are in a “crowded trade”. When such a transaction goes awry, several parties may compete with each other to sell stocks quickly. This risk is higher in a company with no history of growth. You can see Medtronic’s historical revenue and revenue below, but keep in mind that there is always more to tell.

Institutional investors own more than 50% of the company, so together they can likely have a strong influence on the decisions of the board. We note that the hedge funds do not have a significant investment in Medtronic. The Vanguard Group, Inc. is currently the largest shareholder, with 8.3% of the shares outstanding. With 7.8% and 4.1% of shares outstanding, respectively, BlackRock, Inc. and State Street Global Advisors, Inc. are the second and third shareholders.

A closer look at our ownership data shows that the top 25 shareholders collectively own less than half of the ledger, suggesting a large group of small holders where no shareholder has a majority.

While it makes sense to study a company’s institutional ownership data, it also makes sense to study analysts’ sentiments to know which way the wind is blowing. Many analysts cover the stock, so it can be interesting to see what they are forecasting as well.

Medtronic insider ownership

The definition of an insider may differ slightly from country to country, but board members still count. The management of the company is accountable to the board of directors and the board must represent the interests of the shareholders. Notably, sometimes senior executives themselves sit on the board of directors.

I generally consider insider ownership to be a good thing. However, there are times when it is more difficult for other shareholders to hold the board accountable for decisions.

Our data suggests that insiders own less than 1% of Medtronic plc in their own name. Being so important, we wouldn’t expect insiders to own a large chunk of the shares. Collectively, they own $ 177 million in stock. Arguably recent purchases and sales are just as important to consider. You can click here to see if any insiders have bought or sold.

General public property

The general public has a 17% stake in Medtronic. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in line with other large shareholders.

Next steps:

While it is worth considering the different groups that own a business, there are other factors that are even more important. Take risks, for example – Medtronic has 2 warning signs we think you should be aware.

If you are like me, you might want to ask yourself if this business will grow or shrink. Fortunately, you can check out this free report showing analysts’ forecasts for its future.

NB: The figures in this article are calculated from data for the last twelve months, which refer to the 12-month period ending on the last date of the month of date of the financial statement. This may not be consistent with the figures in the annual report for the entire year.

This Simply Wall St article is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell shares and does not take into account your goals or your financial situation. Our aim is to bring you long-term, targeted analysis based on fundamental data. Note that our analysis may not take into account the latest announcements from price sensitive companies or qualitative documents. Simply Wall St has no position in any of the stocks mentioned.

Do you have any feedback on this item? Are you worried about the content? Get in touch with us directly. You can also send an email to the editorial team (at) simplywallst.com.

If you decide to trade Medtronic, use the cheapest platform * which is ranked # 1 overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, currencies, bonds and funds in 135 markets, all from one integrated account.Promoted

[ad_2]