[ad_1]

Every investor in Stratec SE (ETR: SBS) needs to know the most powerful shareholder groups. Institutions often own shares in larger companies, and we would expect insiders to own a noticeable percentage of smaller ones. Warren Buffett said he enjoys “a business with sustainable competitive advantages, led by skilled people and owner-centered.” So it’s nice to see some insider ownership as it may suggest that the management is owner-driven.

Stratec has a market cap of 1.4 billion euros, so we would expect some institutional investors to take notice of the stock. Looking at our data on ownership groups (below), it appears that institutions own shares in the company. Let’s take a closer look at what different types of shareholders can tell us about Stratec.

Check out our latest review for Stratec

What does institutional ownership tell us about Stratec?

Institutional investors generally compare their own returns to the returns of a commonly tracked index. They therefore generally consider buying larger companies that are included in the relevant benchmark.

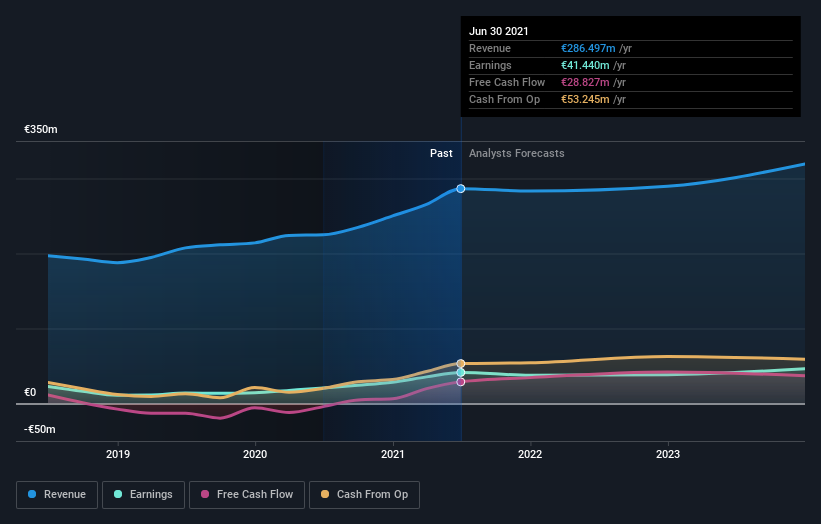

As you can see, institutional investors own a large stake in Stratec. This may indicate that the company has a certain degree of credibility in the investment community. However, it’s best to beware of relying on the so-called validation that comes with institutional investors. They too are sometimes wrong. If several institutions change their mind about a stock at the same time, you could see the stock price drop quickly. So it’s worth checking out Stratec’s earnings history below. Of course, the future is what really matters.

We find that the hedge funds do not have a significant investment in Stratec. Tanja Dinter is currently the largest shareholder in the company with 9.8% of the shares outstanding. For context, the second largest shareholder owns around 9.5% of the outstanding shares, followed by a 9.4% stake by the third largest shareholder.

We dug a little deeper and found that 7 of the major shareholders make up around 54% of the ledger, implying that in addition to the major shareholders there are a few smaller shareholders, thus balancing each other’s interests somewhat. .

Institutional ownership research is a good way to assess and filter the expected performance of a stock. The same can be achieved by studying the feelings of analysts. There are a reasonable number of analysts covering the stock, so it can be helpful to know their overall vision for the future.

Stratec insider ownership

The definition of company insiders can be subjective and vary from jurisdiction to jurisdiction. Our data reflects individual insiders, capturing at least board members. The management of the company manages the company, but the CEO will report to the board of directors, even if he is a member of the board.

I generally consider insider ownership to be a good thing. However, there are times when it is more difficult for other shareholders to hold the board accountable for decisions.

Our information suggests that insiders retain a significant stake in Stratec SE. It has a market capitalization of just 1.4 billion euros and insiders have 443 million euros of shares in their name. It is quite important. Most would be happy to see the board invest alongside them. You may want to access this free chart showing recent insider trades.

General public property

The general public holds 14% of Stratec’s capital. While this property size may not be enough to influence a policy decision in their favor, they can still have a collective impact on company policies.

Owned by a private company

We can see that the private companies own 9.5% of the issued shares. It is difficult to draw conclusions from this fact alone, so it is worth considering who owns these private companies. Sometimes insiders or other related parties have an interest in shares of a public company through a separate private company.

Next steps:

While it is worth considering the different groups that own a business, there are other factors that are even more important. Consider risks, for example. Every business has them, and we’ve spotted 1 warning sign for Stratec you should know.

But finally it’s the future, not the past, which will determine the success of the owners of this business. Therefore, we believe it is advisable to take a look at this free report showing whether analysts are predicting a better future.

NB: The figures in this article are calculated from data for the last twelve months, which refer to the 12-month period ending on the last date of the month of date of the financial statement. This may not be consistent with the figures in the annual report for the entire year.

This Simply Wall St article is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell shares and does not take into account your goals or your financial situation. Our aim is to bring you long-term, targeted analysis based on fundamental data. Note that our analysis may not take into account the latest announcements from price sensitive companies or qualitative documents. Simply Wall St has no position in any of the stocks mentioned.

Do you have any feedback on this item? Are you worried about the content? Get in touch with us directly. You can also send an email to the editorial team (at) simplywallst.com.

If you are looking to trade Stratec, open an account with the cheapest * professional approved platform, Interactive Brokers. Their clients from more than 200 countries and territories trade stocks, options, futures, currencies, bonds and funds around the world from a single integrated account.Promoted

[ad_2]