[ad_1]

If you want to know who actually controls Desktop Metal, Inc. (NYSE: DM), then you will need to examine the makeup of their share ledger. Institutions often own shares in more established companies, while it is not uncommon to see insiders owning a good number of smaller companies. I generally like to see some degree of insider ownership, even if it’s just a little. As Nassim Nicholas Taleb said, “Don’t tell me what you think, tell me what you have in your wallet.

Desktop Metal isn’t huge, but it’s not particularly small either. He has a market capitalization of US $ 2.8 billion, which means he generally expects to see certain institutions listed on the stock register. Our analysis of company ownership, below, shows that institutions are visible on the share register. We can zoom in on the different property groups, to learn more about Desktop Metal.

See our latest review for Desktop Metal

What does institutional ownership tell us about Desktop Metal?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it’s included in a major index. We would expect most businesses to have certain institutions on the registry, especially if they are growing.

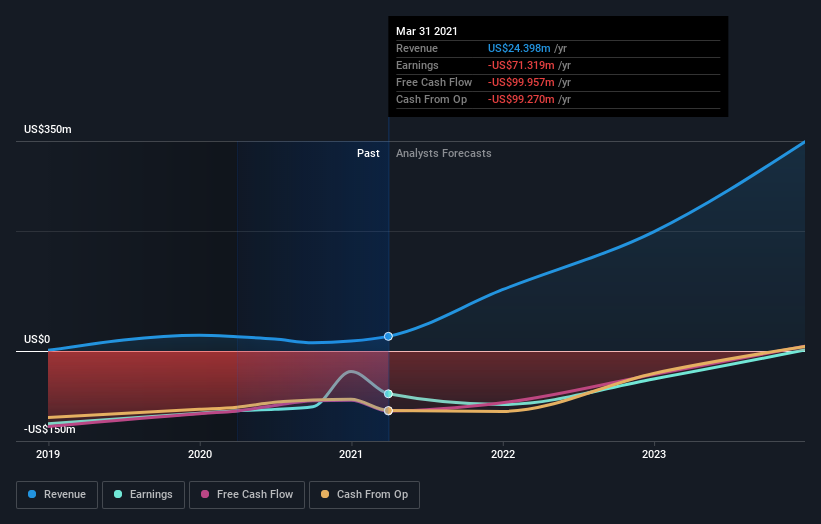

Desktop Metal already has institutions on the share registry. Indeed, they hold a respectable stake in the company. This suggests some credibility among professional investors. But we cannot trust this fact alone because institutions sometimes make bad investments, like everyone else. When several institutions hold a stock, there is always a risk that they are in a “crowded trade”. When such a transaction goes awry, several parties may compete with each other to sell stocks quickly. This risk is higher in a company without a history of growth. You can see Desktop Metal’s historical revenue and revenue below, but keep in mind that there is always more to tell.

Hedge funds don’t have a lot of stock in Desktop Metal. Looking at our data, we can see that the largest shareholder is New Enterprise Associates, Inc. with 11% of the shares outstanding. With 8.6% and 7.3% respectively of the shares outstanding, Ric Fulop and Lux ​​Capital Management, LLC are the second and third shareholders. Ric Fulop, who is the second shareholder, also holds the title of managing director.

We also observed that the top 8 shareholders make up more than half of the share register, with a few smaller shareholders to some extent to balance the interests of the larger ones.

While studying the institutional ownership of a company can add value to your research, it is also recommended that you research analyst recommendations to better understand the expected performance of a stock. There are a reasonable number of analysts covering the stock, so it can be helpful to know their overall vision for the future.

Desktop Metal Insider Property

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. The management of the company manages the company, but the CEO will report to the board of directors, even if he is a member of the board.

Insider ownership is positive when it indicates that executives think like the real owners of the company. However, strong insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

Our information suggests that insiders have a significant stake in Desktop Metal, Inc. Its market capitalization is only US $ 2.8 billion and insiders have US $ 467 million in shares in their own name. It is quite important. Most would be happy to see the council invest alongside them. You may want to access this free chart showing recent insider trades.

General public property

With 28% ownership, the general public has some influence over Desktop Metal. While this group cannot necessarily take the lead, it can certainly have a real influence on how the business is run.

Private shareholders

With a 31% stake, private equity firms are able to play a role in shaping corporate strategy with an emphasis on value creation. Sometimes we see private equity sticking around for the long haul, but generally they have a shorter investment horizon and – as the name suggests – don’t invest much in public companies. After a while, they may seek to sell and redeploy the capital elsewhere.

Owned by a private company

It appears that private companies own 3.7% of Desktop Metal shares. Private companies can be related parties. Sometimes insiders have an interest in a public company through a stake in a private company, rather than in their own capacity as an individual. While it is difficult to draw general conclusions, it should be noted that this is an additional area of ​​research.

Next steps:

While it is worth considering the different groups that own a business, there are other factors that are even more important. Consider, for example, the ever-present specter of investment risk. We have identified 1 warning sign with Desktop Metal, and understanding them should be part of your investment process.

Ultimately the future is the most important. You can access this free analyst forecast report for the company.

NB: The figures in this article are calculated from data for the last twelve months, which refer to the 12-month period ending on the last day of the month of date of the financial statement. This may not be consistent with the figures in the annual report for the entire year.

Promoted

If you are looking to trade Desktop Metal, open an account with the cheapest * professional approved platform, Interactive brokers. Their clients from more than 200 countries and territories trade stocks, options, futures, currencies, bonds and funds around the world from a single integrated account.

This Simply Wall St article is general in nature. It does not constitute a recommendation to buy or sell shares and does not take into account your goals or your financial situation. Our aim is to bring you long-term, targeted analysis based on fundamental data. Note that our analysis may not take into account the latest announcements from price sensitive companies or qualitative material. Simply Wall St has no position in the mentioned stocks.

*Interactive Brokers Ranked Least Expensive Broker By StockBrokers.com Online Annual Review 2020

Do you have any feedback on this item? Are you worried about the content? Get in touch with us directly. You can also send an email to the editorial team (at) simplywallst.com.

[ad_2]