[ad_1]

The large shareholder groups of Office Properties Income Trust (NASDAQ: OPI) have power over the company. Large companies usually have institutions as shareholders, and we usually see insiders holding shares in smaller companies. We also tend to see a decrease in insider ownership in companies that were previously owned by the state.

Office Properties Income Trust has a market cap of US $ 1.4 billion, so we would expect some institutional investors to take notice of the action. In the graph below, we can see that institutional investors have bought into the company. We can zoom in on the different property groups to find out more about Office Properties Income Trust.

Check out our latest analysis for Office Properties Income Trust

What does institutional ownership tell us about Office Properties Income Trust?

Many institutions measure their performance against an index that approximates the local market. Thus, they generally pay more attention to companies that are included in the major indices.

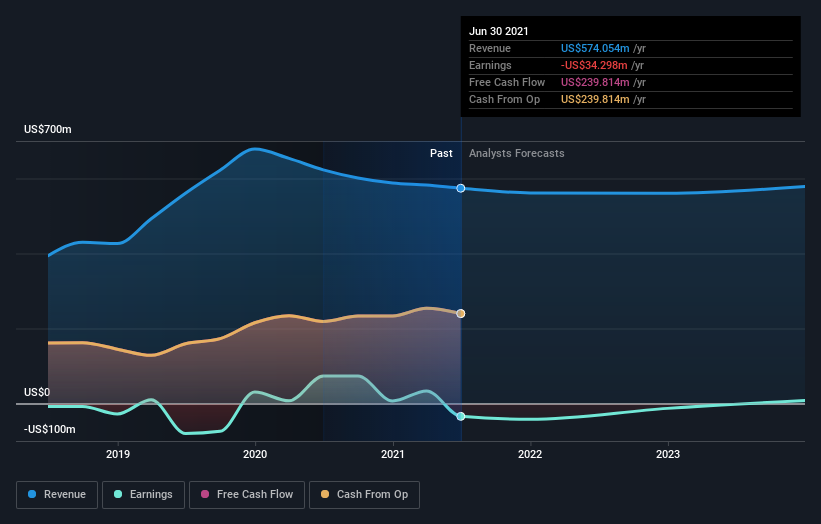

As you can see, institutional investors own a large share of Office Properties Income Trust. This suggests some credibility among professional investors. But we cannot rely on this fact alone because institutions sometimes make bad investments, like everyone else. When several institutions hold a stock, there is always a risk that they are in a “crowded trade”. When such a transaction goes awry, several parties may compete with each other to sell stocks quickly. This risk is higher in a company with no history of growth. You can see Office Properties Income Trust’s historical income and income below, but keep in mind that there is always more to tell.

Institutional investors own more than 50% of the company, so together they can likely have a strong influence on the decisions of the board. We note that the hedge funds do not have a significant investment in Office Properties Income Trust. BlackRock, Inc. is currently the largest shareholder, with 19% of the shares outstanding. Meanwhile, the second and third largest shareholders hold 16% and 5.4% of the outstanding shares, respectively.

We also observed that the top 7 shareholders make up more than half of the share register, with a few smaller shareholders to some extent to balance the interests of the larger ones.

While studying the institutional ownership of a company can add value to your research, it is also recommended that you research analyst recommendations to better understand the expected performance of a stock. There are a reasonable number of analysts covering the stock, so it can be helpful to know their overall vision for the future.

Insider ownership of office buildings Income trust

The definition of company insiders can be subjective and vary from jurisdiction to jurisdiction. Our data reflects individual insiders, capturing at least board members. The management ultimately reports to the board of directors. However, it is not uncommon for managers to be board members, especially if they are founders or CEOs.

Most view insider ownership as a positive, as it can indicate that the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

Our information suggests that insiders of Office Properties Income Trust own less than 1% of the company. It’s a big company, so even a small proportional interest can create alignment between the board and shareholders. In this case, insiders own $ 10 million in shares. It’s always good to see at least one insider property, but it may be worth checking out if those insiders have sold.

General public property

The general public has an 18% stake in Office Properties Income Trust. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in line with other large shareholders.

Next steps:

It’s always worth thinking about the different groups that own shares in a company. But to better understand Office Properties Income Trust, there are many other factors that we need to consider. For example, we discovered 2 warning signs for Office Properties Income Trust which you should know before investing here.

If you are like me, you might want to ask yourself if this business will grow or shrink. Fortunately, you can check out this free report showing analysts’ forecasts for its future.

NB: The figures in this article are calculated from data for the last twelve months, which refer to the 12-month period ending on the last date of the month of date of the financial statement. This may not be consistent with the figures in the annual report for the entire year.

This Simply Wall St article is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell shares and does not take into account your goals or your financial situation. Our aim is to bring you long-term, targeted analysis based on fundamental data. Note that our analysis may not take into account the latest announcements from price sensitive companies or qualitative documents. Simply Wall St has no position in the mentioned stocks.

Do you have any feedback on this item? Are you worried about the content? Get in touch with us directly. You can also send an email to the editorial team (at) simplywallst.com.

[ad_2]