[ad_1]

If you want to know who really controls Wipro Limited (NSE: WIPRO), then you will have to look at the composition of their share ledger. We can see that private companies have the lion’s share of the business with 59% ownership. In other words, the group faces the maximum upside potential (or downside risk).

While institutions that hold 25% came under pressure after the market capitalization fell to 3.4 tonnes last week, private companies suffered the most losses.

In the table below, we zoom in on the different ownership groups of Wipro.

See our latest review for Wipro

What does institutional ownership tell us about Wipro?

Many institutions measure their performance against an index that approximates the local market. Thus, they generally pay more attention to companies that are included in the major indices.

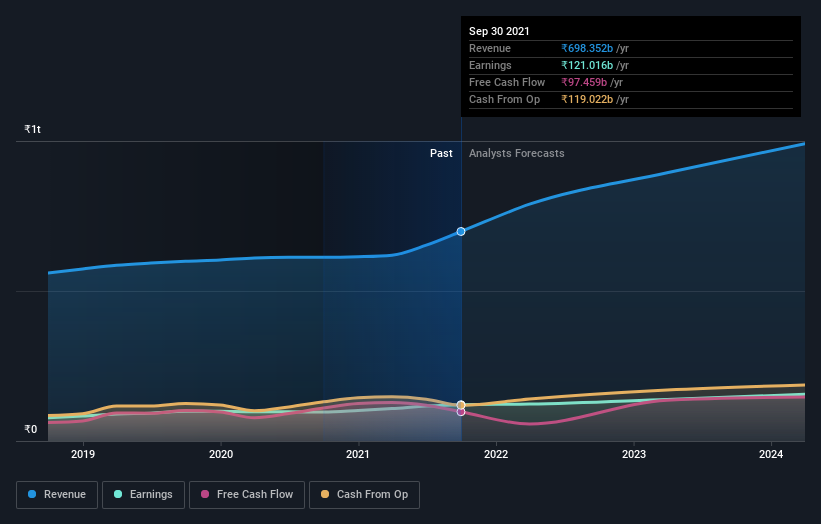

As you can see, institutional investors have a significant stake in Wipro. This may indicate that the company has a certain degree of credibility in the investment community. However, it is better to be careful not to rely on the so-called validation that accompanies institutional investors. They too are sometimes wrong. When several institutions hold a stock, there is always a risk that they are in a “crowded trade”. When such a transaction goes awry, several parties may compete with each other to sell shares quickly. This risk is higher in a company with no history of growth. You can see Wipro’s historical revenue and revenue below, but keep in mind that there is always more to tell.

Hedge funds don’t have a lot of shares in Wipro. Our data shows that Zash Traders is the largest shareholder with 21% of the shares outstanding. Meanwhile, the second and third largest shareholders hold 20% and 17% of the outstanding shares, respectively.

A more detailed study of the register of shareholders showed us that 3 of the main shareholders hold a considerable share of the ownership of the company, through their 58% stake.

While it makes sense to study a company’s institutional ownership data, it also makes sense to study analysts’ sentiments to know which way the wind is blowing. There are a lot of analysts covering the stock, so you can look at expected growth quite easily.

Wipro insider ownership

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. The management of the company is accountable to the board of directors and the board must represent the interests of the shareholders. Notably, sometimes senior executives themselves sit on the board of directors.

I generally consider insider ownership to be a good thing. However, there are times when it is more difficult for other shareholders to hold the board accountable for decisions.

Shareholders would likely be interested to learn that insiders hold shares in Wipro Limited. Insiders have a significant stake worth 156b. It’s good to see this level of investment. You can check here if these insiders have bought recently.

General public property

With an 11% stake, the general public, made up mainly of individual investors, has some influence over Wipro. While this group cannot necessarily take the lead, it can certainly have a real influence on how the business is run.

Owned by a private company

It appears that private companies own 59% of the shares of Wipro. It might be worth pursuing the matter further. If related parties, such as insiders, have an interest in any of these private companies, this should be disclosed in the annual report. Private companies may also have a strategic interest in the business.

Next steps:

I find it very interesting to see who exactly owns a company. But to really understand better, we have to take other information into account as well.

I always like to check a history of revenue growth. You can also, by accessing this free table of historical income and earnings in this detailed graphic.

But finally it’s the future, not the past, which will determine the success of the owners of this business. Therefore, we believe it is advisable to take a look at this free report showing whether analysts are predicting a better future.

NB: The figures in this article are calculated from data for the last twelve months, which refer to the 12-month period ending on the last date of the month of date of the financial statement. This may not be consistent with the figures in the annual report for the entire year.

This Simply Wall St article is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell shares and does not take into account your goals or your financial situation. Our aim is to bring you long-term, targeted analysis based on fundamental data. Note that our analysis may not take into account the latest announcements from price sensitive companies or qualitative documents. Simply Wall St has no position in the mentioned stocks.

Do you have any feedback on this item? Are you worried about the content? Get in touch with us directly. You can also send an email to the editorial team (at) simplywallst.com.

[ad_2]