Financial health is a key component of an individual’s overall well-being. This has never been more true than in the aftermath of the pandemic when, along with mental and physical well-being, financial health became one of the priority areas for employers and individuals. In fact, in a recent survey conducted by fintech platform Rain, around 55% of respondents said that financial issues were their main source of stress, which reiterates the importance of reassuring employees about their future and relieve their financial difficulties.

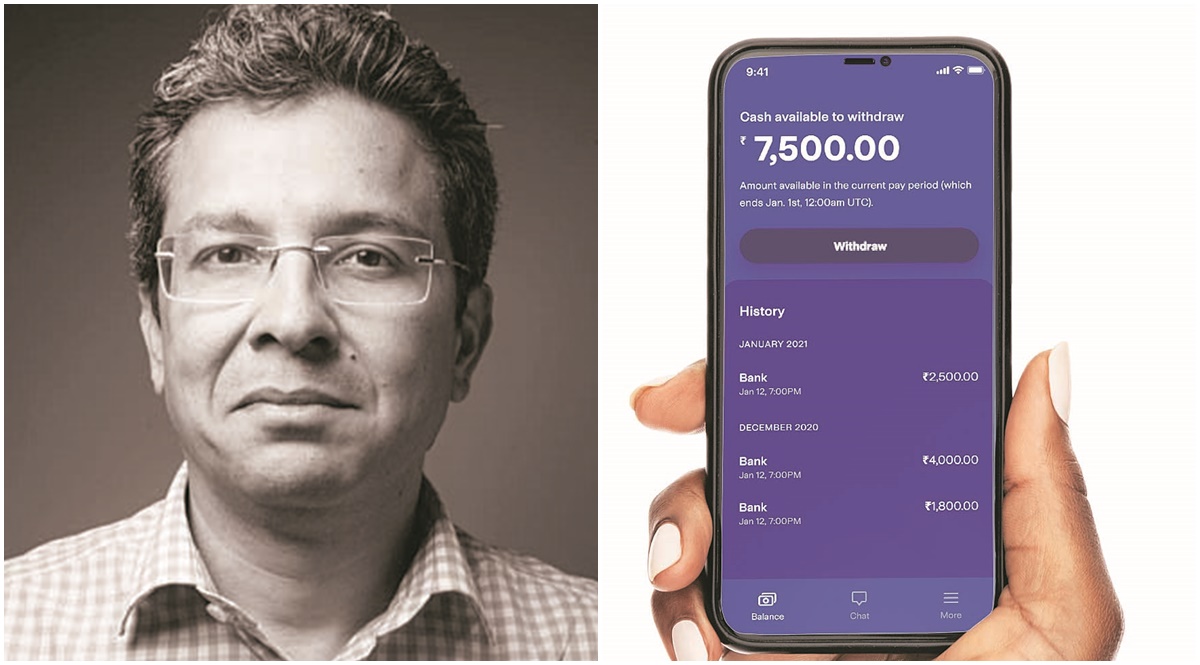

“At Rain, that’s exactly what we aim for,” says its CEO, Akbar Khan. “We want to expand people’s financial freedom, allow them to meet their financial obligations, give them a sense of security and, above all, allow them to make their own choices, rather than falling into the trap of predatory financial products like payday loans. .”

Thus, Rain is a comprehensive financial benefits platform for the well-being of underserved employees. It focuses on empowering employees with paid monetary solutions. The company was established in 2019 by Alex Bradford and Jennifer Terrell in the United States, with its Indian subsidiary being established in December 2020. It is backed by QED, LightSpeed, Dreamers VC, Picus Capital, Jump Capital, CMV, Ethos Capital, and Quad Partners.

The company’s product allows employees to get paid daily instead of waiting for payday. Under normal circumstances, most salaried employees live paycheck to paycheck. However, the fintech allows them to access their salary at any time of the month for the days already worked.

Rain partners with employers and also connects directly with employees to provide on-demand access to earned wages. Employees access their earned pay through the Rain app and can repay it on their payday. “We work across a myriad of industries and industry verticals,” says Khan. “Industry leaders in IT, telecommunications, manufacturing, energy, as well as major enterprise service providers, managed service providers and consulting firms benefit from the platform of Rain.”

Among the features that set Rain apart are hassle-free processes, no hidden fees, and no interest on refunds or EMIs. Through its offerings, Rain strives to help organizations improve retention and productivity, and attract talent.

Khan says the startup has had a great start in the Indian market, “which highlights the huge need for such a product.” Employers have seen improved productivity and employee engagement. As employees appreciate and benefit from having access to on-demand earned pay, “we intend to capitalize on our strong start and move into the next phase of growth,” he adds.

The payday early access fitness platform is a well-funded Series A company. “We have been growing steadily and are ready to leverage our large customer base. We have seen 50% growth month over month and we aim to increase it several times, given the large addressable market and strong demand. “We currently have over 2 million eligible users on our platform and are looking to aggressively increase the numbers in the second half of the year,” he said.

Rain’s larger vision is to build the world’s largest mobile bank for employees. “We have a very comprehensive product pipeline that will help us achieve this goal,” says a confident Khan.

WORKER’S PLEASURE

Rain was created in 2019 by Alex Bradford and Jennifer Terrell in the United States. Its Indian subsidiary was created in December 2020

A well-funded Series A company, it is backed by QED, LightSpeed, Dreamers VC, Picus Capital, Jump Capital, CMV, Ethos Capital and Quad Partners

The company meets the requirements of employers and employees by paying wages earned before payday

It has more than 2 million eligible users on its platform