Sean Pavone/iStock via Getty Images

The profits of Independent Bank Corp. (NASDAQ: INDB) will benefit from a higher average loan balance this year due to the acquisition of Meridian Bancorp late last year. In addition, net income will benefit from a rising interest rate environment. Independent Bank Corp. has plenty of excess cash that it can deploy into higher yielding securities following a hike in the fed funds rate. Overall, I expect Independent Bank to report earnings of $4.48 per share in 2022, up 29% year over year. The year-end target price suggests a slight upside from the current market price. Additionally, the company offers a small dividend yield. Based on the expected total return, I’m adopting a Buy rating on Independent Bank Corp.

Average loan balance will be much higher this year despite attrition plans

After a 6% decline in the first nine months of 2021, the loan portfolio jumped in the last quarter, mainly due to the acquisition of Meridian Bancorp, the parent company of East Boston Savings Bank. The loans acquired increased the size of the loan portfolio by approximately 56% in November 2021, according to details given in the press release.

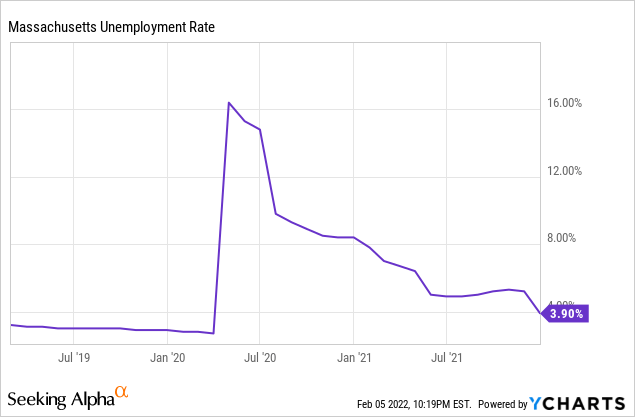

Independent Bank Corp. operates mainly in Massachusetts, whose economy is doing quite well. According to official sources, the state last reported an unemployment rate of 3.9%, which is almost as good as the pre-pandemic level.

Unfortunately, Independent Bank Corp management is not aggressively pursuing organic growth. For 2022, management is targeting low to mid-single digit loan growth, as mentioned on the conference call. Such a low organic growth rate will not be able to compensate for the upcoming scheduled repayments and liquidations.

As mentioned on the conference call, outstanding Paycheck Protection Program (“PPP”) loans totaled $216 million at the end of December 2021, or 1.6% of total loans. I expect most of these remaining loans to be canceled in early 2022, which will limit the growth of the loan portfolio. Additionally, Independent Bank Corp. plans to further reduce East Boston’s portfolio after cutting loans by $500 million last year. According to details given during the conference call, East Boston’s loans totaling approximately $200 million remain to be reduced, representing 1.5% of total loans.

Overall, I expect the size of the loan portfolio to decrease by 1% by the end of December 2022 compared to the end of 2021. Despite the reduction in loans compared to the end of the period, the balance average loans during the year will likely be 34% higher than last year due to the timing of the acquisition. Independent Bank acquired Meridian Bancorp in November 2021, according to a press release.

Meanwhile, I expect deposits to grow normally next year at a low single-digit percentage. The following table shows my income statement estimates.

| EX17 | EX18 | FY19 | FY20 | FY21 | FY22E | ||||

| Financial situation | |||||||||

| Net loans | 6,295 | 6,842 | 8,806 | 9,279 | 13,440 | 13,305 | |||

| Net loan growth | 6.0% | 8.7% | 28.7% | 5.4% | 44.8% | (1.0)% | |||

| Securities | 947 | 1,075 | 1,275 | 2,348 | 4,789 | 4,885 | |||

| Deposits | 6,729 | 7,427 | 9,147 | 10,993 | 16,917 | 17,258 | |||

| Loans and sub-debts | 324 | 259 | 303 | 181 | 152 | 154 | |||

| Common equity | 944 | 1,073 | 1,708 | 1,703 | 3,018 | 3,136 | |||

| Book value per share ($) | 34.5 | 38.8 | 49.7 | 51.5 | 74.8 | 66.2 | |||

| Tangible BVPS ($) | 25.7 | 29.0 | 34.1 | 35.5 | 49.6 | 44.7 | |||

| Source: SEC Filings, Author’s Estimates | |||||||||

| (In millions of dollars, unless otherwise indicated) | |||||||||

Excess cash balance provides opportunity to increase margin

Independent Bank Corp. built up a large cash balance on its books last year. Interest-bearing deposits with banks jumped to $2.1 billion at the end of December 2021, from $1.1 billion at the end of December 2020 and $36 million at the end of December 2019. The accumulation of excess liquidity gives Independent Bank Corp a good opportunity to benefit from the environment of rising interest rates. The company can deploy this excess cash into higher yielding securities once the fed funds rate is raised.

Loan repricing and maturities in a rising interest rate environment will also contribute to the margin this year. As mentioned on the conference call, about 20-25% of loans will immediately benefit from an increase in the fed funds rate. This proportion of loans is not too high, but it is still significant.

Management’s interest rate sensitivity analysis presented in Q3’s 10-Q filing shows that a 100 basis point increase in interest rates could increase net interest income by 8.4 % over twelve months. Given the factors mentioned above and guidance from management, I expect the margin to increase four basis points in 2022 from 3.05% in the last quarter of 2021.

Revenue is expected to grow 29% year-over-year

Higher average loan balances and expanding spreads will likely drive earnings growth this year. Additionally, the efficiency ratio will likely improve once the cost savings from the Meridian Bancorp merger materialize. I expect the efficiency ratio to improve to 55% by the fourth quarter of 2022 from 77% in the fourth quarter and 62% in the third quarter of 2021. However, the efficiency ratio will remain likely high in the first quarter of 2022. as there are still approximately $5-6 million of merger-related costs to be incurred, as mentioned in the conference call.

Meanwhile, non-interest income will likely come under pressure from lower swap income. This fee income was exceptionally high in the last quarter as the company executed certain swaps. Management mentioned on the conference call that this high performance is unlikely to be replicated this year. Moreover, the provisioning charge will probably return to a normal level this year. The existing level of provision comfortably covers the credit risk of the portfolio. Provisions represented 1.08% of total loans, while non-performing loans represented 0.20% of total loans at end-December 2021, as mentioned in the earnings release.

Overall, I expect Independent Bank to report earnings of $4.48 per share in 2022, up 29% year over year. The following table shows my income statement estimates.

| EX17 | EX18 | FY19 | FY20 | FY21 | FY22E | ||||

| income statement | |||||||||

| Net interest income | 259 | 298 | 393 | 368 | 402 | 574 | |||

| Allowance for loan losses | 3 | 5 | 6 | 53 | 18 | 8 | |||

| Non-interest income | 83 | 89 | 115 | 111 | 106 | 118 | |||

| Non-interest charges | 204 | 226 | 284 | 274 | 333 | 412 | |||

| Net income – Common Sh. | 87 | 122 | 165 | 121 | 121 | 212 | |||

| BPA – Diluted ($) | 3.19 | 4.40 | 5.03 | 3.64 | 3.47 | 4.48 | |||

| Source: SEC Filings, Author’s Estimates | |||||||||

| (In millions of dollars, unless otherwise indicated) | |||||||||

Actual earnings may differ materially from estimates due to risks and uncertainties related to the COVID-19 pandemic.

Adopting a buy rating due to a decent expected total return

Independent Bank Corp. has steadily increased its dividend every year since 2011. Given the earnings outlook, I expect this tradition to continue in 2022 and Independent Bank to increase its quarterly dividend from $0.02 per share to $0.50 $ per share. This dividend estimate suggests a dividend yield of 2.4%, using the February 4 closing price.

I use historical price/tangible (“P/TB”) and price/earnings (“P/E”) multiples to value Independent Bank. The stock has traded at an average P/TB ratio of 2.2 in the past, as shown below.

| EX17 | EX18 | FY19 | FY20 | FY21 | Medium | ||

| Tangible BVPS ($) | 25.7 | 29.0 | 34.1 | 35.5 | 49.6 | ||

| Average market price ($) | 67.4 | 78.3 | 77.8 | 66.4 | 80.0 | ||

| Historical PER | 2.6x | 2.7x | 2.3x | 1.9x | 1.6x | 2.2x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | |||||||

Multiplying the average P/TB multiple by the expected tangible book value per share of $44.7 yields a target price of $99.2 for the end of 2022. This price target implies an upside of 17.0% compared to the closing price on February 4. The following table shows the sensitivity of the target price to the P/TB ratio.

| Multiple P/TB | 2.02x | 2.12x | 2.22x | 2.32x | 2.42x |

| TBVPS – Dec 2022 ($) | 44.7 | 44.7 | 44.7 | 44.7 | 44.7 |

| Target price ($) | 90.3 | 94.7 | 99.2 | 103.7 | 108.2 |

| Market price ($) | 84.8 | 84.8 | 84.8 | 84.8 | 84.8 |

| Up/(down) | 6.5% | 11.7% | 17.0% | 22.3% | 27.6% |

| Source: Author’s estimates |

The stock has traded at an average P/E ratio of around 19.1x in the past, as shown below.

| EX17 | EX18 | FY19 | FY20 | FY21 | Medium | ||

| Earnings per share ($) | 3.19 | 4.40 | 5.03 | 3.64 | 3.47 | ||

| Average market price ($) | 67.4 | 78.3 | 77.8 | 66.4 | 80.0 | ||

| Historical PER | 21.1x | 17.8x | 15.5x | 18.2x | 23.1x | 19.1x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | |||||||

Multiplying the average P/E multiple by the expected earnings per share of $4.48 yields a price target of $85.7 for the end of 2022. This price target implies a decline of 1.1% from at the February 4 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| Multiple P/E | 17.1x | 18.1x | 19.1x | 20.1x | 21.1x |

| EPS 2022 ($) | 4.48 | 4.48 | 4.48 | 4.48 | 4.48 |

| Target price ($) | 76.8 | 81.2 | 85.7 | 90.2 | 94.7 |

| Market price ($) | 84.8 | 84.8 | 84.8 | 84.8 | 84.8 |

| Up/(down) | (9.5)% | (4.2)% | 1.1% | 6.4% | 11.7% |

| Source: Author’s estimates |

An equal weighting of the target prices from the two valuation methods gives a target price of $92.5, implying a 9.1% upside from the current market price. Adding the forward dividend yield gives an expected total return of 11.4%. Therefore, I adopt a buy rating on Independent Bank Corp.