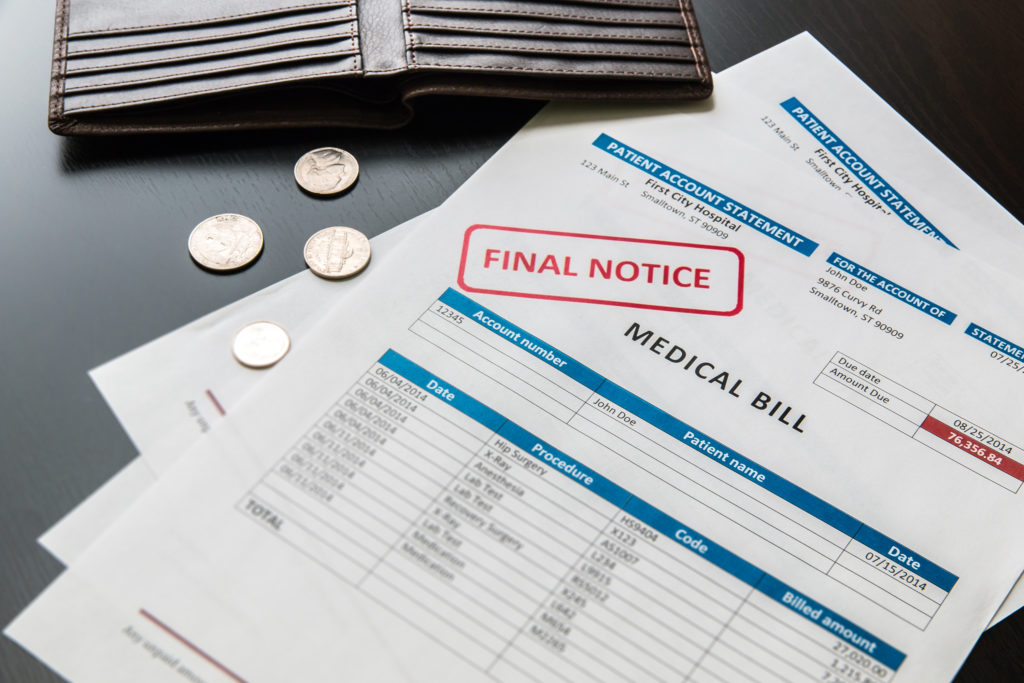

With rising inflation and a looming recession, the medical debt crisis in the United States is about to get worse. Americans owe more than $140 billion in unpaid medical bills, which is the nation’s leading cause of bankruptcy.

Seven states – California, Colorado, Illinois, Maryland, New Mexico, Virginia and Washington – passed medical debt legislation last year aimed at increasing the effectiveness of financial aid programs hospitals. The Affordable Care Act requires nonprofit hospitals to offer and advertise financial assistance programs — which have great potential to prevent medical debt for low-income patients struggling to pay for health care — but they are currently seriously underutilized.

Every year, millions of patients who would have qualified for financial assistance under their hospital’s financial assistance policy end up with medical debt that they cannot pay. For many reasons – such as complicated applications with heavy requirements or simple lack of awareness that the program even exists – the very patients for whom these programs are designed often fall through the cracks.

As more states prepare legislation to make healthcare services more affordable by requiring more generous and patient-friendly hospital financial assistance policies, here are the key features that make the laws effective in addressing the medical debt.

Clear income standards for eligibility

Although the Affordable Care Act requires the existence of financial assistance programs for hospitals, it does not specify who should be eligible. The American Hospital Association recommends that hospitals provide free care to patients below 200% of federal poverty guidelines. Many hospitals offer discounts of up to 400% of the guidelines. Washington State codifies a sliding scale with free care up to 200% to 400% poverty guidelines.

To provide context of what 300% of the federal poverty guidelines look like – an elderly couple with an annual income of up to $54,930 or a young family of four with an income of up to $83,250 . People in this income bracket, especially those with large health insurance deductibles, need help maintaining affordable access to health care. Requiring hospitals and health systems to provide free care to patients with slightly higher incomes is a great way to do this.

Include underinsured patients in financial assistance

One of the biggest loopholes in state and federal medical debt law doesn’t include underinsured patients. Virginia and Illinois legislation is insufficient. The term “underinsured” is used to describe patients who have insurance but still cannot afford to pay their share of the health care bill.

In America, the average single deductible is $1,945 and the average family deductible is $3,722. High-deductible health plans have become increasingly popular over the past decade and can include deductibles of up to $10,000 or more. Patients with lower incomes cannot afford these amounts, even after their health insurance pays their part of the bill. Hospital financial assistance policies should offer the same discount percentages to underinsured patients as to uninsured patients.

Limit assets considered for eligibility

Regardless of income, it is not unreasonable to deny financial assistance to a patient with $1 million in the bank. However, it is important to limit the types of assets that can be considered in a financial assistance determination.

Best practice is to focus on the liquid assets available for patient payment – cash, checking, and savings account balances. Including non-residential real estate (holiday homes/income properties) in the calculation is also reasonable.

The most effective legislation regarding assets to be included in financial assistance policies prevents home equity in a primary residence, retirement account balances, life insurance cash value, and property values. to be considered in determining a patient’s financial assistance. We’ve seen patients approaching retirement age with woefully underfunded 401(k) accounts being asked by their healthcare system to borrow from their $50,000 401(k) to pay a medical bill. hospital. This shouldn’t happen.

Streamline the application process

A common challenge to hospital financial assistance programs is an overly cumbersome and complicated application process for patients. Patients may be given a three- to four-page application form that includes a separate page of instructions on how to complete it. This adds to a long list of documents that may be needed to prove household income.

Maryland is the first state to require hospitals to use a uniform financial aid application. This approach would be effective if the application was simple to complete. Unfortunately, the Maryland application form is not particularly patient-friendly.

This includes monthly expenses such as rent/mortgage payment, utilities, car insurance, health insurance, year/makes of vehicles owned, etc. It is important to simplify the application process for patients and only ask for information that is relevant to determining financial assistance, such as income and certain types of assets.

Promote awareness of hospital financial assistance

Most patients simply do not know about the availability of financial aid in their hospital. If they hear about ‘financial assistance’ or ‘charitable care’, they usually think they have to be unemployed or homeless to qualify.

Some new laws require hospitals to refrain from attempting to collect a bill before determining whether a patient is eligible for financial assistance or the state Medicaid program. This is a step in the right direction, but the primary goal of outreach should be to make financial assistance programs easier for patients to access and navigate on their own.

Under the Affordable Care Act, hospitals must include a “plain language summary,” which is meant to be shorter and easier for patients to read and understand. New standards need to be set for what constitutes “plain language” as most hospital financial assistance programs. Plain language summaries require patients to do their own calculation of their household income as a percentage of federal poverty guidelines and often do not specify all items. the hospital’s eligibility criteria in its policy, such as asset testing, service area, etc.

If free or discounted care seems at odds with our private healthcare system in the United States, consider that nonprofit hospitals enjoy tax-exempt status because of their important role in the community. Treating anyone, regardless of their ability to pay, is part of the mission of almost every hospital. With medical debt on the rise, there is clearly a gap here that needs to be filled.