We are

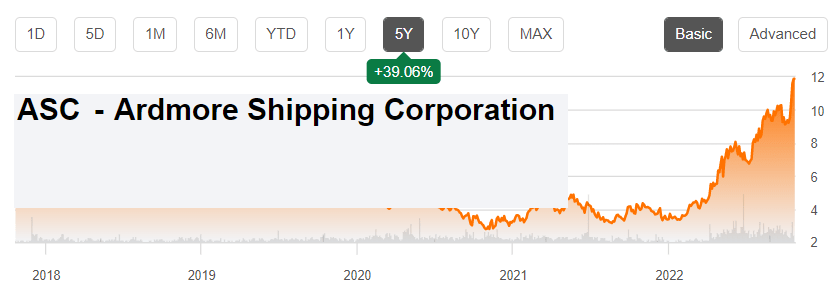

Ardmore Shipping Corporation (NYSE: ASC) recently posted exceptional quarterly figures thanks to an increase in asset values and strong market conditions. In my view, new energy efficiency and emissions reduction strategies could lead to significant growth in FCF revenue and margins. With that, my discounted cash flow models did not result in significant upside potential. I believe the maximum fair value for Ardmore could be around $14 per share and in the worst case the stock price could drop to $8 per share. In short, I will not buy shares at the current share price.

Ardmore Expedition

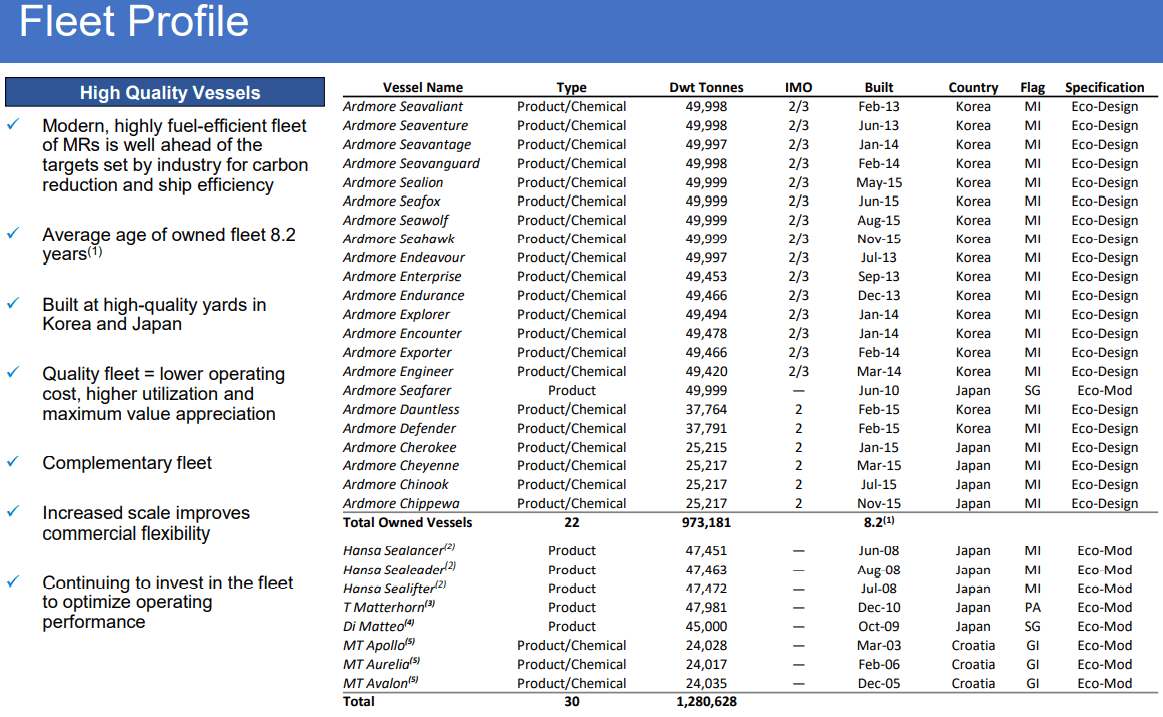

Ardmore Shipping owns and operates chemical tankers in the global trade. The company claims to have high-quality vessels, an average age close to 8.2 years, a fuel-efficient fleet, and increasing scale and improved flexibility.

Quarterly presentation July 2022

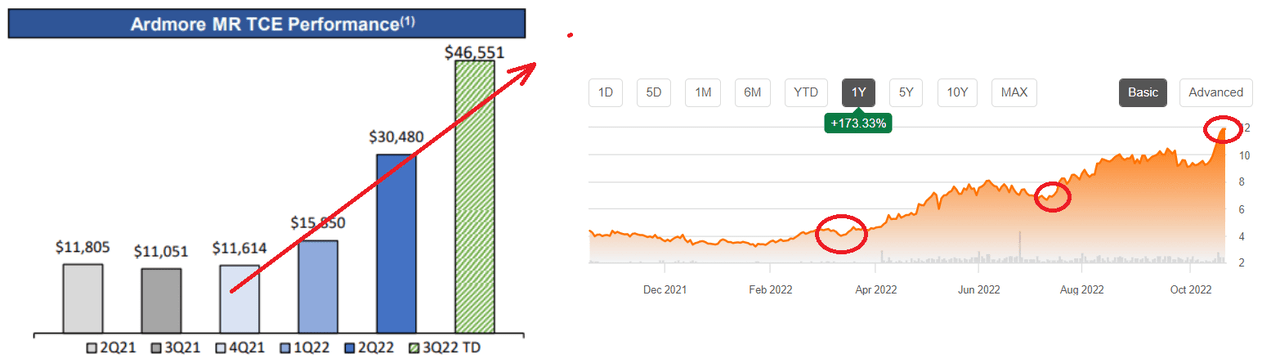

I believe that the information reported in the last quarterly report is a good reason to study Ardmore. Management noted strong dynamics and impressive performance. In my opinion, if the company continues to deliver big numbers, demand for the stock could increase even further, even considering that the stock is already expensive.

The product and chemical tanker markets remain at historically high levels, with many factors now contributing to the current momentum. Source: Quarterly presentation July 2022

Source: July 2022 Quarterly Presentation and Seeking Alpha

Although we don’t like the current stock price, the strength of the market is driving up the company’s profitability. Management is posting very impressive numbers with double-digit sales growth.

Asset values are also rising as buyers now factor in strong market conditions to price estimates, most recently the sale of a 2016-built MR at $34.5 million, up 26% from $27.5 million at the start of the year. Source: Quarterly presentation July 2022

It should also be noted that many banks have decided to refinance part of the company’s portfolio because the company is doing very well. In my opinion, more investors might be willing to take a look at the company’s balance sheet right now.

We have recently completed the refinancing of substantially all of our debt with major lending banks, reducing our higher cost charter portfolio from 14 vessels to two, and we have also committed to limited use of the ATM during last quarter to further strengthen our financial strength. Source: Quarterly presentation July 2022

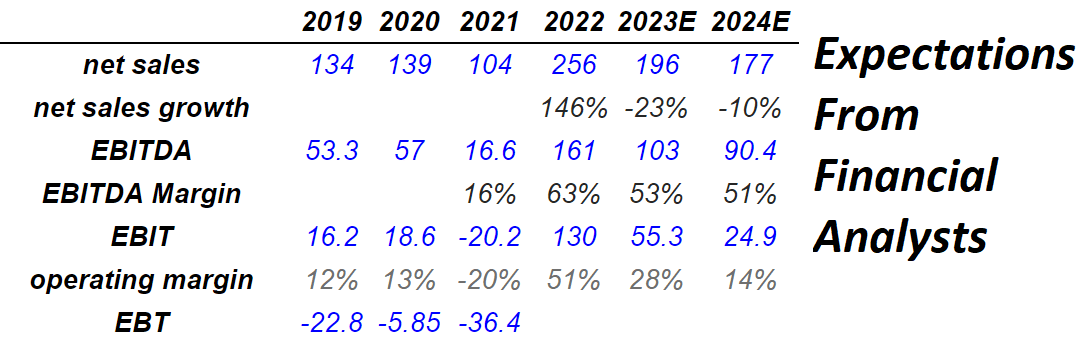

Financial analysts expect lower sales growth in 2023 and 2024

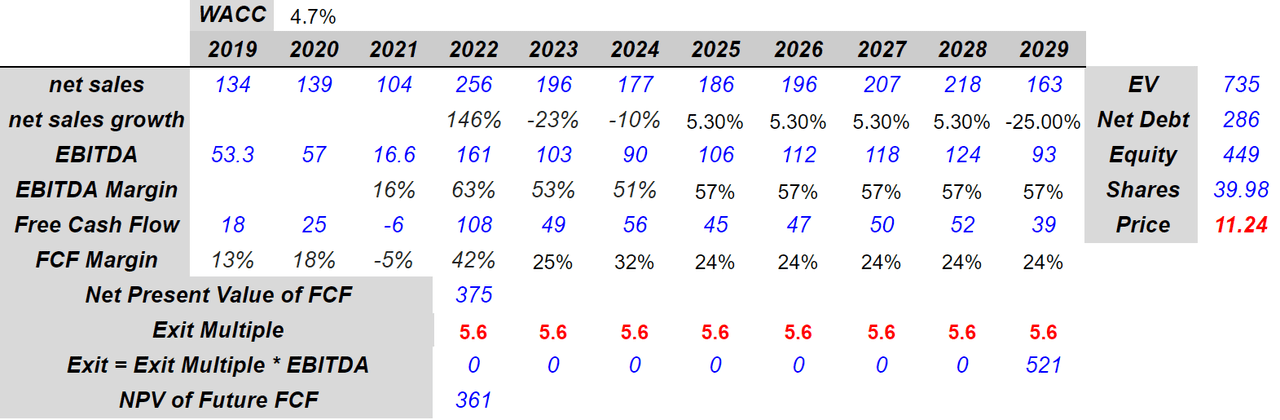

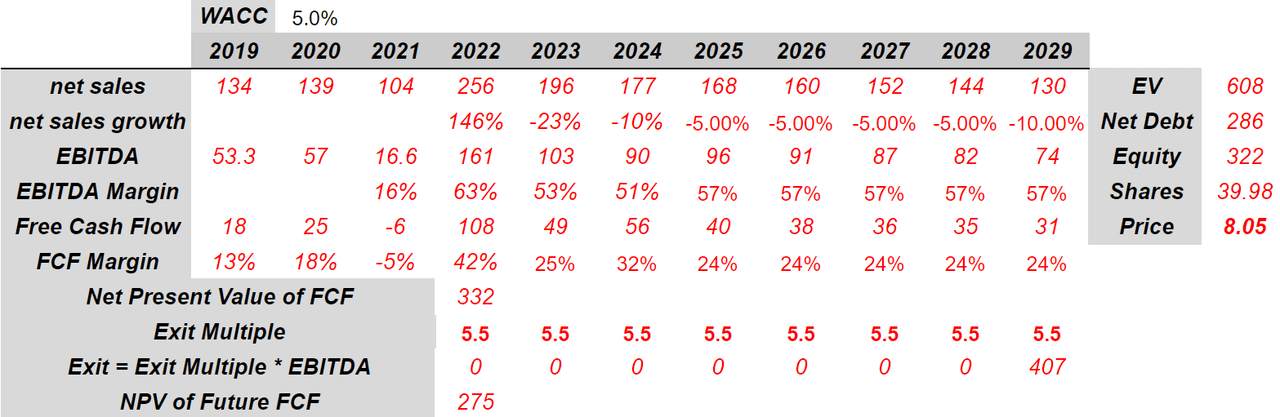

Financial analysts forecast 2024 net sales of $177 million, EBITDA of $90.4 million and an EBITDA margin of 51%. Additionally, EBIT will likely be $24.9 million, with an operating margin of 14%.

marketscreener.com

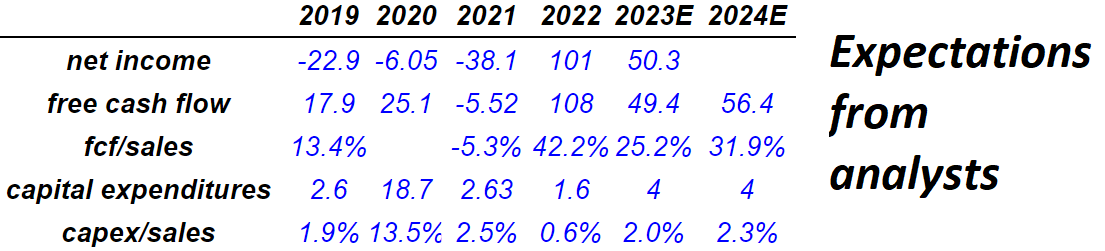

The estimates also include a net profit of $50.3 million for 2024, which could be appreciated after many years of negative results. Finally, financial analysts also expect 2024 free cash flow of $56.4 million and FCF/sales of 31.9%. Note that I used some of them in my financial models.

marketscreener.com

Balance sheet: good financial shape with little debt

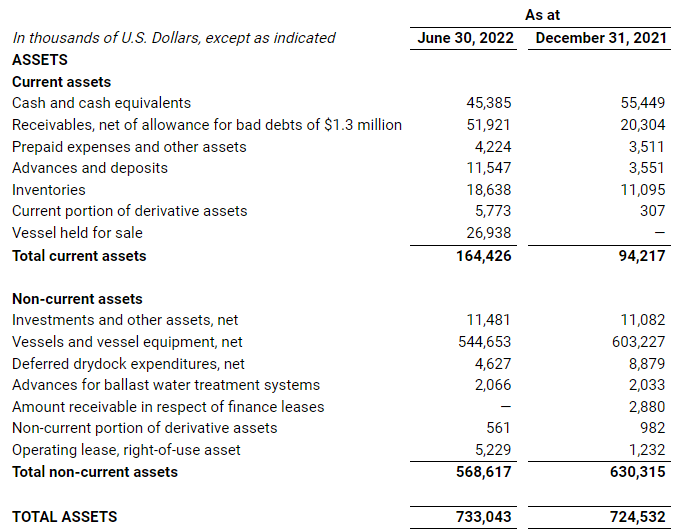

As of June 30, 2022, the company reported cash and cash equivalents of $45 million and advances and deposits of $11 million. Vessels held for sale amount to $26 million and total current assets equal $164.426 million. The ships and ship equipment are worth $544 million. Total non-current assets are worth $568 million and total assets are $733 million. The asset to liability ratio of the company is greater than one, so I would say the company is doing well.

Quarterly presentation July 2022

The total amount of current liabilities is low, so I don’t expect a liquidity crisis anytime soon. Accounts payable was $6 million, accrued liabilities and other liabilities were $13 million, plus deferred revenue of $1.455 million. The current portion of long-term debt was $15 million, the current portion of finance lease obligations was $24 million, and the current portion of operating lease at $2.293 million. Finally, management noted total current liabilities of $64 million.

On the other hand, the non-current portion of long-term debt was $118 million, in addition to the non-current portion of finance lease obligations of $173 million. Finally, other non-current liabilities amounted to $943 million, with total liabilities amounting to $359 million.

Quarterly presentation July 2022

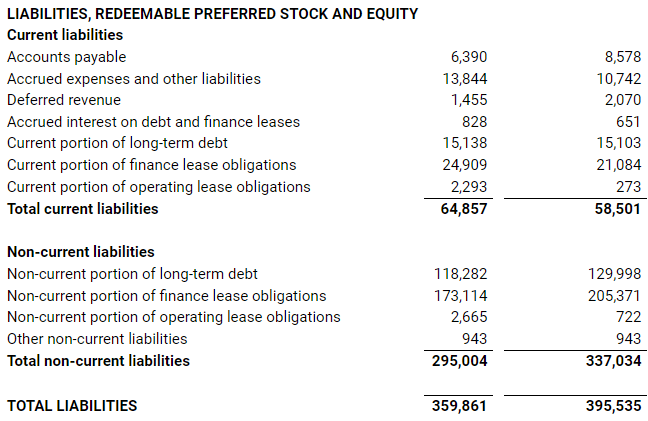

As of June 30, 2022, in addition to senior debt of $106 million, the company reported revolving credit facilities of $26,491 million and total net debt of $286 million.

Quarterly presentation July 2022

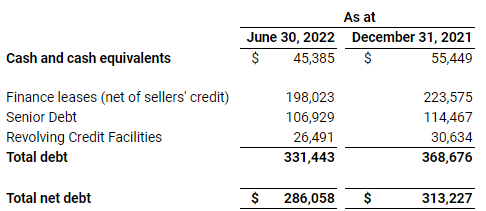

My base case scenario involved a valuation of $11.24 per share

Under normal conditions, I would expect sales growth close to 5.32% as the global transportation fuels market is expected to grow at this rate:

Global Transportation Fuels Market to grow USD 1,763.64 Billion by 2027, at a CAGR of 5.32%. Source: The World Transport Fuels Market

In this base case scenario, I assumed that the company’s energy efficiency and emissions reduction strategies would improve both FCF margins and sales growth. Besides, I think the company’s Eco-design and Eco-mod ships will probably attract more investors’ attention. Demand for inventory could also increase. Therefore, the company’s cost of equity would likely remain moderate.

We believe we are at the forefront of energy efficiency and emission reduction trends and are well placed to capitalize on these developments with our fleet of Eco-design and Eco-mod vessels. Our acquisition strategy is to continue to build our fleet with eco-designed new ships or eco-designed used ships and with modern used ships that can be upgraded to eco-mod. Source: 20-E

Now, if we also assume a conservative EBITDA margin close to 57%, an FCF margin of around 24% and an exit multiple close to 5.6x, the implied enterprise value would be $734 million. The implied price would be $11.24, which is close to the most recent market price. In this model, I would say that the company is priced correctly.

My DCF model

I think there is a downside risk and the upside potential is not that big

I tried to design several discounted cash flow scenarios to understand if buying more stock would make sense right now. In the worst case, I got a valuation lower than the current share price.

I assumed that one of Ardmore’s biggest clients wouldn’t work with the company that much. In the past, the company had two clients that represented more than 10% of the company’s consolidated revenue for the year ended December 31, 2021. This is a major risk in my view:

We have derived, and may continue to derive, a significant portion of our revenue and cash flow from a limited number of customers. BP represented 10% or more of our consolidated revenue for the year ended December 31, 2021. Vitol Group represented 10% or more of our consolidated revenue for the year ended December 31, 2020. Source: 20 -F

I also think Ardmore could experience a significant drop in FCF margins as a result of wage increases or new collective bargaining. The company has noted these risks in the annual report. In the worst case scenario, I believe that if some equity researchers provide information on these risks and a possible margin squeeze occurs, the stock price could drop significantly.

A significant portion of the seafarers who sail on our ships are employed under collective agreements. If not resolved in a timely and cost-effective manner, industrial action or other industrial unrest could prevent or impede the conduct of our business as planned and could have a material adverse effect on our business, results of operations and our financial condition. Source: 20-E

With previous bearish assumptions, I also used a 5% discount, -5% decline in sales growth from 2025 to 2028, and an FCF margin of around 25%. The exit multiple is 5.5x, implying net debt close to $285 million and a fair price of $8.05 per share. Note that the downside risk, at this time, seems significant. Right now, the stock is trading between $11 and $13. I’m not saying Ardmore won’t go up to $15 or even $20. I’m just saying that future free cash flow probably wouldn’t be enough to justify such valuations.

My DCF model Source: SA

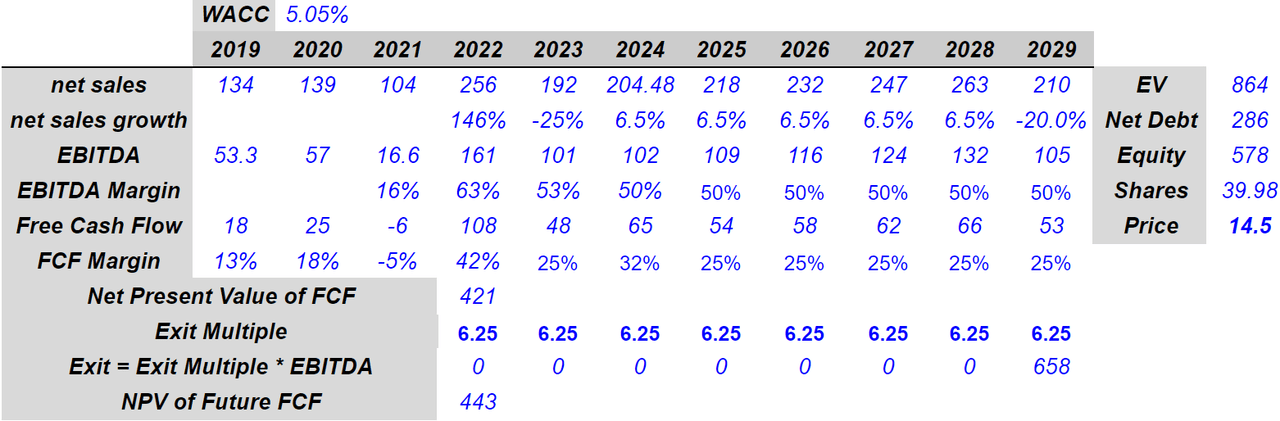

My best case scenario would involve a valuation of $14.5 per share

I think the company’s balance sheet would allow management to acquire used vessels, which could improve revenue growth. Economies of scale would also improve the company’s FCF/Sales. It should be noted that the acquisition of second-hand vessels seems to be part of the company’s strategies. Purchasing new ships and ordering new ships could also be a possibility for Ardmore:

Our business strategy includes further growth through the acquisition of new and used vessels.

We plan to purchase and order additional ships from time to time. Source: 20-E

In this optimistic scenario, with a WACC of 5.05%, sales growth close to 6.5% and an FCF margin close to 25%, the NPV of future FCF would be close to $420 million. If we also use an exit multiple of 6.25x, the stock valuation would reach almost $575 million and the fair price would remain at $14.5 per share.

My DCF model

Conclusion

Ardmore is a fantastic business model with an outstanding fleet portfolio and talented management. I am convinced that the company will generate greater revenue growth in the years to come through the acquisition of new vessels and other energy efficiency and emission reduction strategies. With that, I don’t believe the current stock price represents a real opportunity. In my view, the current valuation does not include significant potential for stock price appreciation. I would try to buy more stocks under $8.