pawel.gaul

This article was co-produced with Cappuccino Finance.

The Big Five (Royal Bank of Canada, Toronto-Dominion Bank, Bank of Nova Scotia, Bank of Montreal and Canadian Imperial Bank of Commerce) are the largest banks in Canada and they dominate the Canadian banking landscape.

Thanks to their size and the regulatory barriers on the sector, the five big banks benefit from large economic moats.

These Big Five banks control substantial assets, maintain a superb balance sheet with plenty of cash on hand, and are more profitable than other smaller banks.

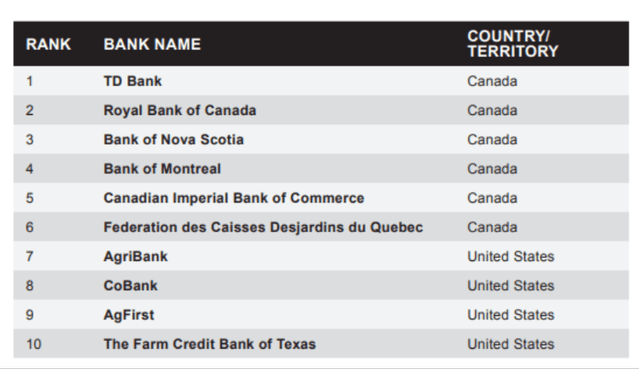

The quality of their assets and balance sheets is clearly demonstrated by their positions in the top five places of the list of the safest banks in North America by Global Finance.

Safest banks in North America 2021, Source: Global Finance

On top of that, they’ve been shareholder-friendly, paying a strong dividend and buying back stock. Some of them have a dividend sequence exceeding 150 years.

The liquidation of 20 to 25% of the major Canadian banks seems exaggerated, as dividends increase. Short-term volatility is to be expected, but investors with a buy and hold strategy might want to start adding bank stocks to their portfolios at these levels.

Recent market volatility and concerns about a housing bubble in Canada have caused their stock prices to fall, but I believe this is a market overreaction.

The big five Canadians will be fine.

Price declines have just created an opportunity to grab stocks at a bargain price and attractive yield.

The next three (Royal Bank of Canada, Toronto Dominion and Bank of Nova Scotia) are my favorite stocks, and all of them combine growth and dividend stability.

Royal Bank of Canada (RY)

Royal Bank of Canada is a diversified multinational bank based in Toronto. The bank offers personal and business banking, home equity financing, mortgages, mutual funds, brokerage accounts and credit card services. It is the largest bank in Canada by asset value ($1.4 billion).

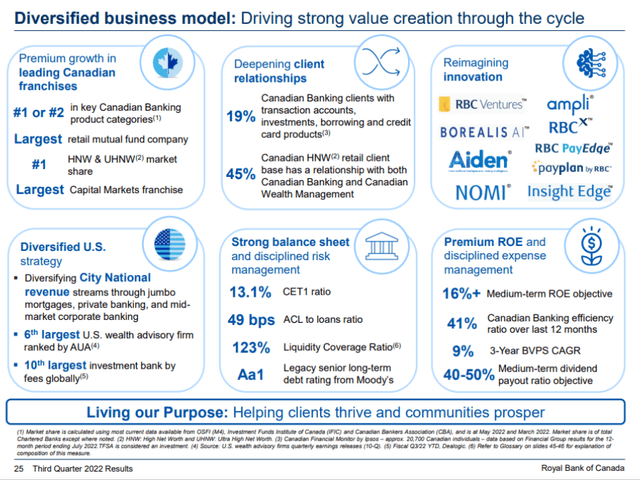

Royal Bank of Canada is the recognized leader in Canadian banking. They hold a highly diversified portfolio, product lines ranked #1 or #2 in the industry, and strong customer relationships. The balance sheet is very solid, represented by a high level of Common Equity Tier 1 (CET1) and a solid liquidity coverage ratio (123%).

They are also more profitable than others, as evidenced by their high ROE. The recently proposed acquisition of Brewin Dolphin (the UK’s leading wealth manager) will further diversify its portfolio and boost its growth trajectory.

Source: Investor Relations

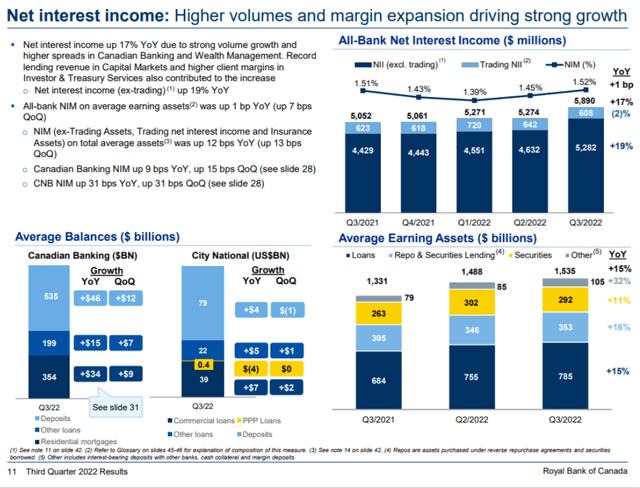

Although it noted some uncertainties in its earnings announcements, Royal Bank of Canada posted a strong quarter. Their net interest income was up 17% year-on-year, driven by strong volume growth and higher yield spreads in Canadian banking and wealth management.

Average retail deposit balances are about 30% above pre-pandemic levels, and corporate balance sheets and personal savings are stable and healthy across the board. Their Super Prime group shifted its cash to higher yielding offerings during the quarter.

They recorded a larger provision for credit losses as macroeconomic conditions deteriorate, and this larger provision contributed to lower net income in the quarter.

Source: Investor Relations

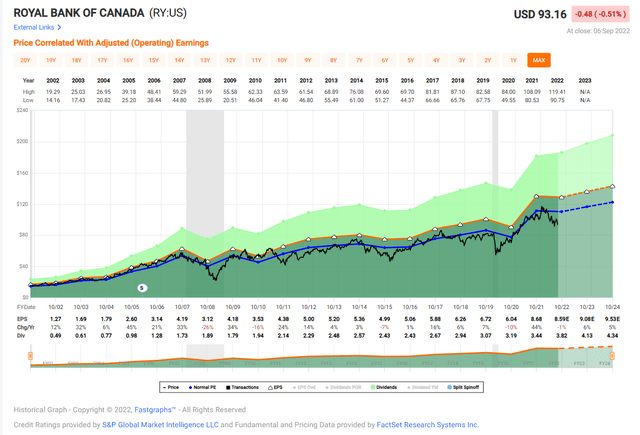

Buoyed by its strong performance and strong balance sheet, Royal Bank of Canada repurchased 10 million shares and paid $1.8 billion in dividends this quarter. They have consistently increased the dividend (4.63%, 5 year CAGR) and I expect them to continue in the future.

Given their valuation, the P/E ratio of 10.81x is significantly lower than their normal P/E ratio of 12.29x (5-year average). This lower valuation is caused by recent market volatility and a less optimistic economic outlook for Canada and the United States. But given their strong balance sheets and wide economic moat, I expect them to weather any economic cycle comfortably.

QUICK charts

Toronto Dominion (TD)

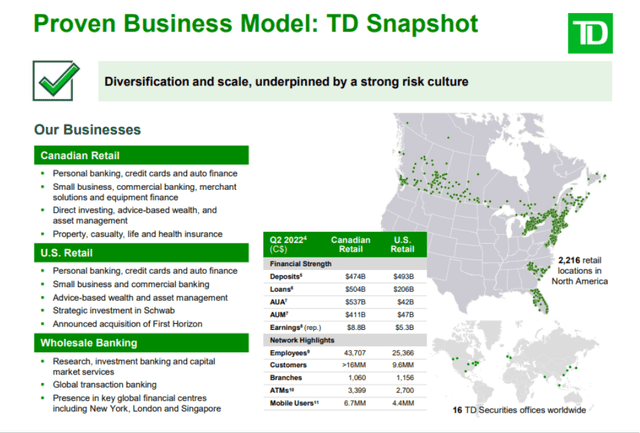

Toronto-Dominion serves more than 27 million customers worldwide and has more than 2,000 outlets in North America. Toronto-Dominion operates through three major segments: Canadian Retail, US Retail and Wholesale Banking.

Source: Investor Relations

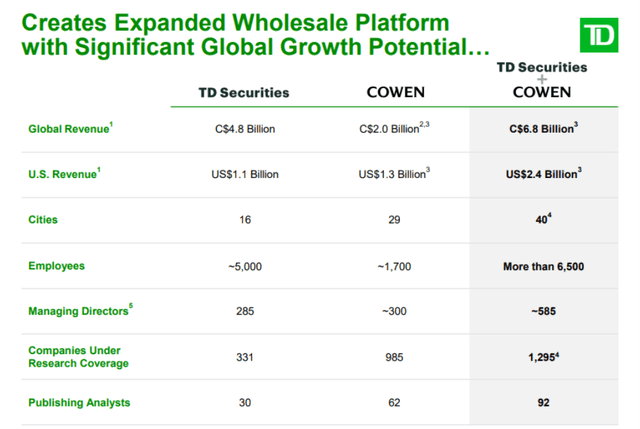

In addition to the acquisition of First Horizon Bank announced earlier this year, Toronto-Dominion made another big move by announcing the acquisition of Cowen.

Because Cowen is a leading independent broker with a strong and diversified investment bank, the acquisition will significantly increase revenue and strengthen TD Securities’ services. TD Securities will benefit from the addition of strong talent (1,700 colleagues), greater presence (29 cities) and long-term growth (revenue synergy of $300-350 million).

Source: Investor Relations

The term of the purchase was $39 per share and $1.3 billion in total (100% cash consideration). Although Toronto-Dominion used a lot of cash for this transaction, the CET1 ratio should still remain above 11%, demonstrating the strength of Toronto Dominion’s balance sheet. The expected return on investment after achieving full synergy is around 14% for the acquisition.

During the last quarter, Toronto-Dominion posted excellent earnings, beating both EPS and revenue estimates. Their Canadian retail segment earned $2.3 billion on record revenue of $7 billion. Their card business performed very well, with loan volume up 10% year-on-year as consumer spending remained robust. The corporate banking segment also recorded strong growth, driven by double-digit loan growth.

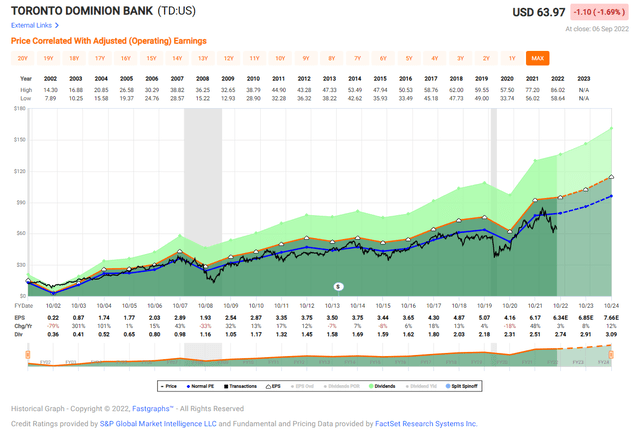

Given their valuation, the P/E ratio of 10.1x is around 20% lower than their 5-year average (12.0x). Uncertainty surrounding the Canadian real estate market, recession fears and hawkish central banks (both Canadian and US) are the main reasons for falling stock prices and the current low valuation.

Given their strong balance sheet and expected synergies from First Horizon Bank and Cowen, I expect Toronto-Dominion to continue to grow. Their revenues and earnings will continue their long-term growth trajectory, and shareholders will be rewarded with strong dividend growth and stock appreciation.

Toronto-Dominion’s dividend is well covered with a 42% payout ratio, and I expect them to continue to increase the dividend (8.10%, 5-year average).

QUICK charts

Bank of Nova Scotia (BNS)

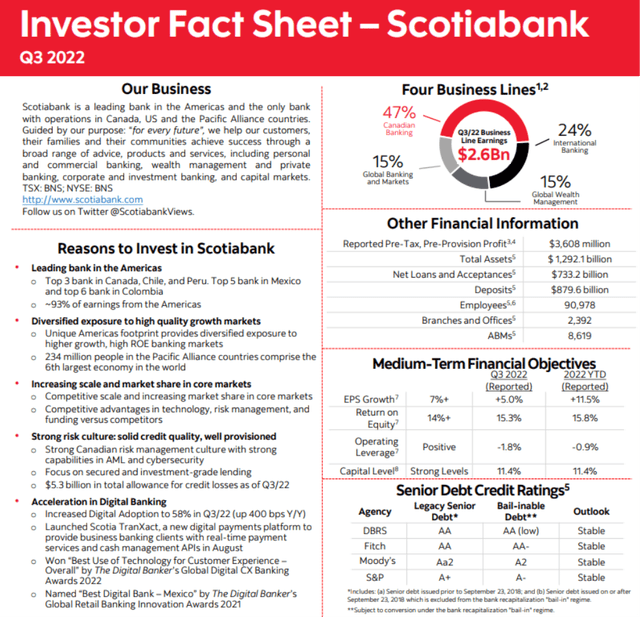

The Bank of Nova Scotia, or Scotiabank, is Canada’s third largest bank and offers a wide range of advice, products and services, including personal banking, commercial banking, wealth management and investment banking services.

Scotiabank offers a good combination of growth and stability. Their portfolio is diversified across high-quality markets that present strong growth opportunities, represented by a strong EPS growth target of 7% (11.5% in YTD 2022).

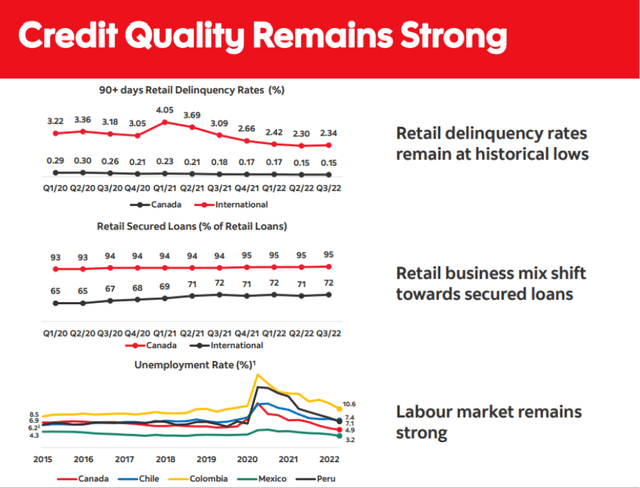

Return on equity is reasonably strong at 15.3% in 2022. As mentioned in the intro, Scotiabank is one of the safest banks in North America (ranked 3rd) and their senior credit ratings are AA, Aa2 and A+ (Fitch, Moody’s and S&P respectively) with a stable outlook. Literally, shareholders’ money is in safe hands with Scotiabank.

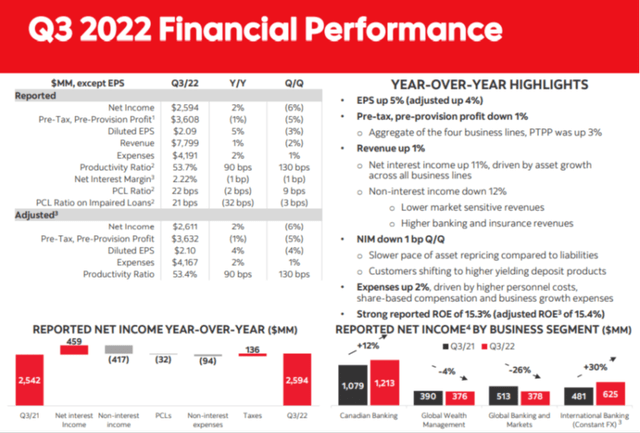

Source: Investor Relations

In the latest quarterly earnings call, Scotiabank reported strong earnings of $2.6 billion ($2.10 per share), up 4% from a year ago. Strong personal, business and commercial banking led to another strong quarter for Scotiabank. Net interest income increased 11% year-on-year, driven by asset and loan growth across all of their business segments.

The impact of high inflation and low consumer confidence was offset by a strong labor market and low defaults. Overall consumer spending in Canada has also shown resilience, helped by strong deposit balances and strong employment.

Source: Investor Relations

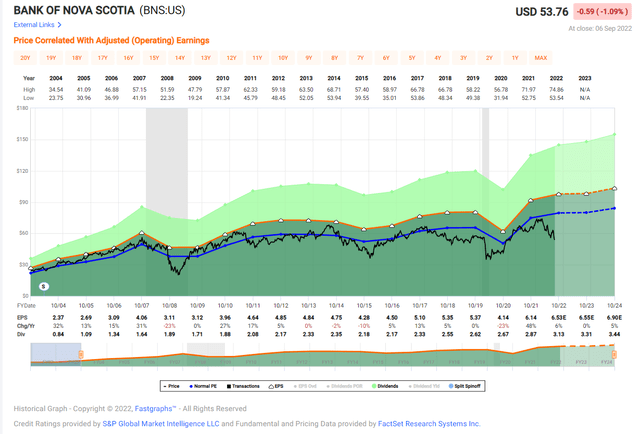

Scotiabank’s stock price has fallen from $75 per share in March to its current level of around $55 per share, and this has created a good entry point for an investor looking for a opportunity for stock appreciation with a strong dividend payout.

Source: Investor Relations

Their dividend yield is 5.86%, and given their strong balance sheet and growth trajectory, I expect their stock price to recover. Their P/E ratio of 8.17x is simply too low for a high quality bank like Scotiabank. Moreover, their valuation is around 25% lower than their historical average (10.99x, 5-year average).

During the past quarter, Scotiabank repurchased approximately five million shares (31 million shares year-to-date) and is committed to rewarding shareholders through its share buyback program. shares.

I also expect them to continue to increase their dividend (4.7% growth, 5-year average). Their dividend is well covered with a payout ratio of 47%. Economic uncertainty and high inflation may pose challenges for Scotiabank in the short term, but I remain confident that they will provide significant long-term gains.

QUICK charts

Carry

The stock market, and to some extent the whole world, is full of uncertainties these days: ongoing Russian-Ukrainian war, oil production, high inflation, supply chain disruption and (always) Covid lockdowns. The list continues.

More specifically for the Canadian market, there are growing concerns about the Canadian real estate market. All of these uncertainties have combined to bring a lot of volatility to the stock market.

In turn, this volatility drove down the price of blue-chip stocks like Royal Bank of Canada, Toronto-Dominion and Scotiabank.

However, these three banks have outstanding balance sheets with ample cash on hand, so I expect them to weather an economic downturn very well and continue their long-term growth.

Additionally, Royal Bank of Canada and Toronto-Dominion have made key acquisitions that will boost their growth trajectories.

Therefore, I will take the recent drops in their price as a welcome gift. This is a great opportunity to add these stocks at a bargain price, while collecting a juicy dividend.

Note: We posted “What You Need to Know About Foreign Dividend Withholding Taxes” for iREIT members on Alpha.