[ad_1]

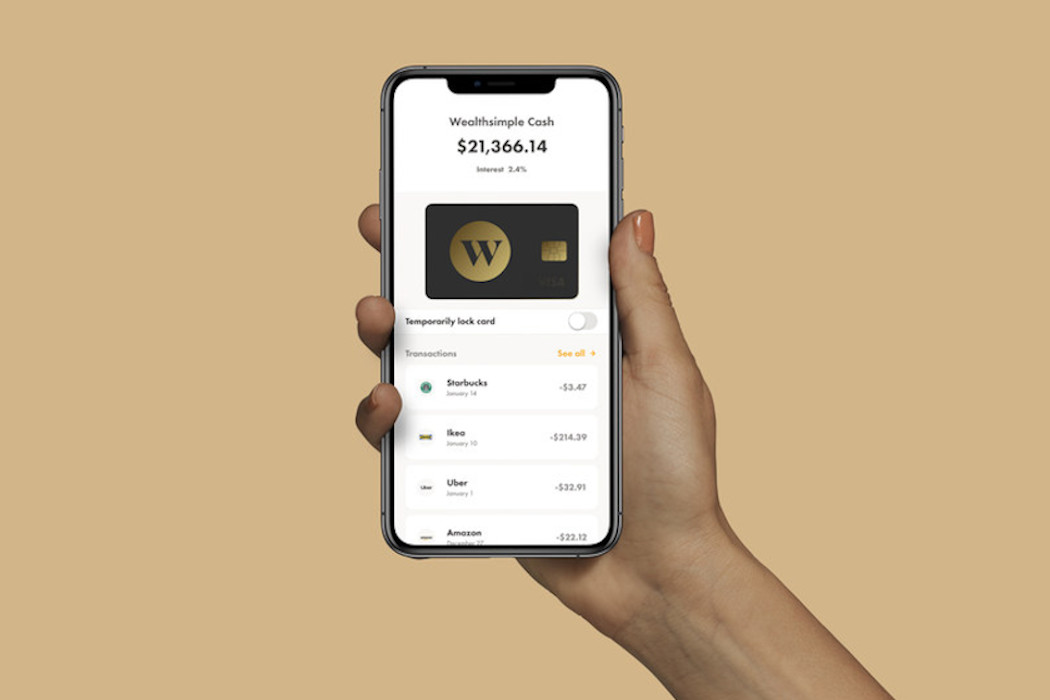

Toronto-based FinTech startup Wealthsimple has launched its new consumer payments app, Wealthsimple Cash, for users across Canada.

Similar to Venmo, Wealthsimple Cash is currently a peer-to-peer payment app that allows users to send, receive, and request money instantly. First announced in January 2020, Wealthsimple began rolling out the first feature of its new Beta Cash product to select employees and customers last November. As of today, the app is now available to all Canadian users in the Apple App Store and Google Play.

“Ultimately our goal is to offer a payment product that allows users to do everything from one account,†said a spokesperson for Wealthsimple.

The move represents Wealthsimple’s first expansion into the spending space. “Ultimately, our goal is to offer a payments product that allows users to do everything from a single account, including digital spending, bill paying and direct deposit,†said a company spokesperson at BetaKit, adding that the company plans to continue to evolve and adapt the app “over the next few months” based on customer needs and feedback.

According to Wealthsimple, the app allows users to send, receive, and request money from family and friends in seconds. It doesn’t require any security questions: to start sending and requesting money, users just need to download the app and connect their contacts.

Wealthsimple has announced plans to launch a Cash card soon, which users can add to Apple and Google Pay. The company said the launch of its Cash card has been postponed due to manufacturing delays associated with COVID-19.

The company also plans to launch a series of other new features in the coming months, including bill payments, digital direct deposits, pre-authorized debits, ATM cash withdrawals, and no exchange fees on purchases. . The larger Wealthsimple Cash account should be a hybrid spending savings account. Many of these features are similar to those provided by Koho, another Canadian FinTech startup (the two companies are notably backed by capital from Power Corp).

“The digital payments landscape in Canada mirrors the rest of our financial industry – it’s outdated and cumbersome,†said Michael Katchen, co-founder and CEO of Wealthsimple.

RELATED: FinTechs on the Fence as Interac Chosen for Canada’s Real-Time Payments Provider

“We exist to simplify financial products, and we believe Wealthsimple Cash does exactly that in the peer-to-peer payments space,†Katchen said. “It’s a fun and easy new way to send and receive money instantly with family and friends. “

Wealthsimple Cash is free, does not involve transfer limits, monthly account fees, or minimum balance requirements. Users can send each other up to $ 5,000 per day and $ 20,000 per month. According to Wealthsimple, users’ money is “insured by SADC up to specified limits”. Accounts are secured using biometrics, fingerprint identification, and two-factor authentication. To increase privacy, users can control who can find them on the app.

Wealthsimple recently sold its US business portfolio to Betterment, citing plans to focus more on the Canadian market. The popularity of one of the startup’s other financial services apps, Wealthsimple Trade, has skyrocketed amid the recent Reddit-fueled trading frenzy. According to Wealthsimple, more than 1.5 million people currently use the startup’s products.

Photo courtesy of Wealthsimple

[ad_2]