This marks a significant drop of 48% from projected revenues of around Rs 4,400 crore cited in unaudited results from Think & Learn Pvt Ltd, which runs the edtech company that has come under scrutiny from its accounting practices in recent months.

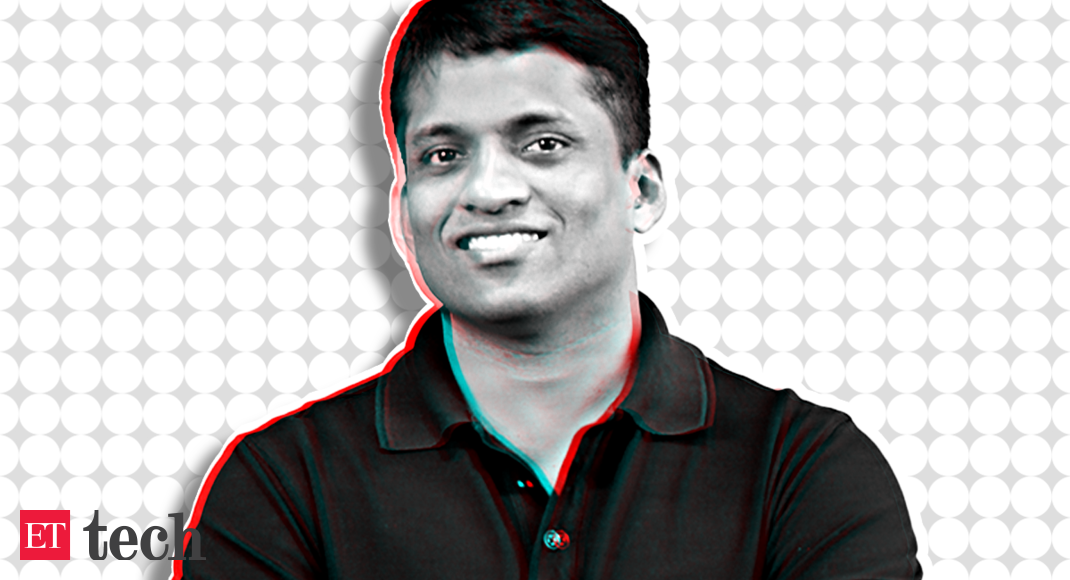

ET was the first to report in its September 12 edition the discrepancy between Byju’s unaudited earnings and the official accounts now approved by startup audit firm Deloitte Haskins & Sells. Over the past week, Byju’s Founder and CEO Byju Raveendran had notified company shareholders of the discrepancies, attributing it to business model changes due to the Covid-19 pandemic, ET reported, citing multiple people. aware of the development.

Speaking to ET on Wednesday, Raveendran said the company saw “significant revenue growth from fiscal year 2020, but due to changes in revenue recognition, it’s pushed back to the next fiscal year.”

He insisted that “there is no loss of revenue that is reported in the audit report, due to which (which) there will be more growth in FY22” .

The Bengaluru-based startup, currently valued at $22 billion, has seen the filing of its audited results delayed by nearly 18 months as Deloitte’s audit arm raised concerns over several contentious issues in the company’s accounts. company.

Discover the stories that interest you

In the notes accompanying the audited financial results – reviewed by ET – Deloitte said that Byju’s revenue from streaming services (the online courses it sells), which was previously recognized in full at the start of the contract, has been adjusted to be recognized over the period of the Contract. In addition, interest on loans – granted directly to customers – but paid by Byju’s on their behalf, has been reclassified from finance costs and adjusted to income, as these payments are in the nature of payments to customers, the firm said. audit.

These two major changes in accounting led to a huge reduction in the online tutoring platform’s revenue and also led to big losses. Raveendran said the losses of Rs 4,588 crore incurred by the business were equally split between Byju’s and Whitehat Jr, which it acquired in 2020. revenues have not been out); we also closed most of the acquisitions in 2021, which compounded the losses.”

The educator-turned-entrepreneur said the past few months had been “difficult” as the company faced questions as it delayed filing its audited accounts.

ETtech

ETtechLast month, the Ministry of Corporate Affairs (MCA) sent a communication to Byju’s asking it to explain why financial accounts for FY21 have not been submitted so far.

“While the audit backlog was there, the fraud story was false…there was no misrepresentation as you suggest…I’ve had calls with many investors and nobody cares because they don’t care about FY21 numbers but look at FY22 and FY23 numbers…” Raveendran said.

Byju’s said it received an unqualified report for the 2021 financial year from its auditor, Deloitte Haskins & Sells, with no misstatements noted in its financial statements.

In a press release, the edtech company said on Wednesday that for the financial year 2022, it recorded gross revenue of Rs 10,000 crore. Admittedly, these are still unaudited results.

Business model changes

Raveendran said changes to its financials for FY21 were in line with what the auditor believed was fair. Additionally, some of the revenue recognition fixes are based on business model changes, he added. “When there are significant changes in the recognition, auditors have to do more work. The initial delay was due to Covid-19 and the second part was just the time needed to rework the recognition,” he said. declared.

Raveendran said the percentage of sales on credit (funded through NBFCs and lending partners) was much higher during Covid when e-learning was in demand. This led to the change in revenue recognition for FY21, he said, when asked why Deloitte insisted on changes.

“It’s not that we’re resisting this change in revenue recognition. If you ask me, I’ll let revenue roll over from last year to next year at any time. That’s how the valuation increases… Also, we weren’t pushing aggressive earnings reporting that we’ve been following a similar pattern this whole time and that’s why you’re seeing that delta,” Raveendran told ET.

Blackstone payment, cash trail, financing plan

Regarding the company’s cash position, Raveendran said that the company has enough money in the bank even after the payments that must be made to the Blackstone private equity fund due to the acquisition of Aakash Educational Services Ltd (AESL) conducted in April 2021.

ETtech

ETtechByju’s had delayed payments to Blackstone and extended the payment deadline until the end of September, people familiar with the matter said. The edtech company is to pay an additional $250 million to Blackstone, these people said.

“There is a procedural delay, for payments from Blackstone, under RBI guidelines that must be adhered to,” Raveendran said. We have plenty of cash and over the next six months we will be raising funds as there will be a lot of consolidation in the US market which we would like to take advantage of… cash has never been a challenge for us,” said he added.

Raveendran said he was able to diversify formats and grow as a global downturn hit the online education sector. “My investors are still very excited… A lot of edtech companies have flourished during Covid but there is a global downturn in the industry. However, we have been able to diversify our offerings… Aakash, Great Learning are growing fine, the only cost of acquisition challenge (bringing in new students) is up to Whitehat Jr,” he said.

Funding missing

Meanwhile, the startup has yet to receive $300 million from its previous funding round from investors – Sumeru Ventures and Oxshott Capital – out of the $800 million seed round the company announced in March 2022. This investment did not materialize, according to Raveendran who himself injected $400 million into the company through debt financing from American financiers. The edtech company also raised $1.2 billion in Term B loans last November for its international expansion. “If you go to investors when you need the money, you’ll never get it, right? You have to raise when you don’t need it – that’s when you raise to your terms,” he said, adding that there hasn’t been a single month that he hasn’t been in talks with potential investors.

Regarding its IPO plans, Raveendran said it was unlikely to go for public market listings in the next 12 months. “Public markets themselves are on pause globally. So why will we go when no one else is going to the market? This is not a question for us alone but it is based on macros,” he said, adding that it was postponed by 12 months. The company was looking to acquire US edtech company 2U for which it was finalizing debt financing, but those plans are also on the back burner, people familiar with the matter said.